The premium smartphone market growth is remarkably strong, defying economic uncertainties. Indeed, this segment, typically exceeding the £700/$700 threshold, continues to thrive. Consumers, therefore, are increasingly investing in high-end devices. A smartphone is no longer merely a communication tool. Instead, it serves as a central hub for work, entertainment, and creativity. From facilitating remote work tasks to unlocking digital creativity, these devices are indispensable. This article explores the multifaceted drivers behind this upward trend. We will examine key statistics and dissect technological innovations fueling higher price points. Furthermore, we analyze why consumers are willing to pay more, delving into both psychological and practical reasons. Consequently, understanding this profound shift in consumer values is crucial. Join us to uncover why flagship phone prices continue to soar without abating.

The Unstoppable Ascent: Decoding Premium Smartphone Market Growth

The premium smartphone market growth shows remarkable expansion, consistently surpassing saturation and price sensitivity. This robust ascent signals a profound shift in consumer spending, reorienting the ecosystem towards higher-value devices and strong high-end phone trends.

The premium segment’s market share reflects this. Defined by devices over $600 wholesale, it surged from 15% in 2020 to 25% by 2024. This 10-point increase highlights vitality and consumer appeal, driving premium segment increase.

This premium smartphone market growth actively outpaces the general market. In 2024, the premium segment expanded 8% year-on-year, exceeding the overall market’s 5% growth. This sector drives value, reflecting a significant flagship device surge. Ultra-premium phones ($1,000+ wholesale) are soaring.

Ultra-premium devices now account for over 40% of the entire premium market. This reveals strong consumer preference for top-end variants and fuels expensive phone demand. Buyers invest in pinnacle technology, seeking the ‘best of the best’ experience.

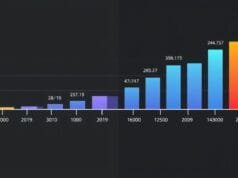

Global smartphone ASP steadily rises. Projected to reach nearly $300 in 2025 and $330 by 2029 (from $287 in 2024), this trend is driven by inflation and rising component costs, influencing high-end phone trends and sustaining overall premium smartphone market growth.

Geographic Dynamics Driving Premium Smartphone Market Growth

North America and Europe remain pivotal for premium smartphone market growth. Robust economies and high disposable incomes create ideal environments for high-end phone trends. South Korea and Japan lead in ASP due to tech-savvy populations, fueling luxury mobile expansion. US ranks third globally in ASP, UK fourth.

China, a formidable player in premium smartphone market growth, rapidly increased its premium segment share to 24% globally in 2024. This stems from its massive domestic market and rising consumer aspirations, supporting premium segment increase. Emerging markets like India (fivefold growth since 2020) and Latin America (2.5 times growth) show exponential expensive phone demand, facilitated by financing.

A critical behavioral shift underpins premium market growth: lengthening smartphone upgrade cycles, coupled with greater willingness to spend. Consumers hold onto devices longer; 72% replaced devices three years old or more in H1 2024, compared to 52% in 2021, highlighting a key high-end phone trend.

This extended ownership period means consumers increasingly invest in a premium model during an upgrade. A higher initial cost amortizes over several years, justifying the investment in a premium smartphone. This allows consumers to choose devices offering longevity, superior performance, and a future-proof experience, further sustaining expensive phone demand.

The Pillars of Price Driving Premium Smartphone Market Growth

The escalating price tags of premium smartphones are not arbitrary. They are meticulously justified by a blend of tangible advancements and intangible benefits. These devices represent the pinnacle of mobile engineering, offering features and experiences that consistently set them apart from mid-range counterparts. Understanding these drivers is key to comprehending why consumers are increasingly willing to allocate a larger portion of their disposable income to high-end gadgets, thus supporting the premium smartphone market growth.

Technological Innovation Fueling Flagship Device Surge

Premium smartphone pricing primarily stems from relentless technological innovation. Manufacturers continuously push boundaries, integrating cutting-edge components and software. These advancements demand significant research, development, and production costs, representing genuine leaps in capability and user experience, contributing to the flagship device surge.

A key driver of premium smartphone market growth is the integration of AI-powered processors. Chips like Apple’s A-series and Qualcomm’s Snapdragon 8 Gen series are more than just fast; they are intelligent. Their Neural Processing Units (NPUs) enable sophisticated on-device AI, enhancing computational photography, real-time language translation, and advanced security. The complexity and power of these silicon innovations are central to the premium experience.

High-resolution cameras remain a top priority for premium buyers, driving high-end phone trends. Manufacturers deliver increasingly sophisticated multi-lens systems. Beyond raw megapixels, computational photography is paramount, using AI to enhance low-light performance, correct distortions, and create stunning portraits. Features like 8K video and advanced stabilization transform smartphones into powerful pocket cameras, justifying their place in the luxury mobile expansion.

Consumer Demand Driving Premium Segment Increase

Advanced displays are another cornerstone of the premium experience and a key factor in the premium segment increase. AMOLED panels, with vibrant colors and deep blacks, are now expected. High refresh rates (120Hz) ensure buttery-smooth scrolling. Adaptive refresh rate technologies (LTPO displays) dynamically adjust to conserve battery. Furthermore, foldable screens, such as Samsung’s Galaxy Z series or Google’s Pixel Fold, represent a significant engineering feat, offering novel form factors at a premium cost.

Today, 5G connectivity is a ubiquitous expectation in premium phones, delivering faster speeds and more reliable connections crucial for seamless streaming and gaming. Beyond connectivity, premium devices offer superior overall performance and design, utilizing premium materials like aerospace-grade aluminum or titanium, with precision-engineered haptics. Enhanced durability through strengthened glass and advanced ingress protection (IP ratings) are essential differentiators, justifying the elevated cost and driving expensive phone demand.

Brand Image and Prestige Contributing to Luxury Mobile Expansion

Beyond raw specifications, consumers are increasingly prioritizing overall quality and experience from their premium devices. The decision to purchase a premium smartphone often reflects a desire for reliability, longevity, and a consistently superior user interaction. For many, a phone represents an investment in their daily digital life, contributing to the ongoing luxury mobile expansion.

Consumers actively seek superior performance, durability, and an exceptional user experience. They want a device that feels fast, responsive, and robust enough for daily use. Features such as camera quality, battery life, and processor speed consistently rank as top priorities for premium buyers. A phone that can capture stunning photos, last a full day, and handle demanding applications without lag is a powerful draw for the premium segment increase.

There is a strong perception that higher-priced smartphones equate to better technology and craftsmanship. This belief, reinforced by marketing and user reviews, leads many to favor premium brands. Consumers trust that devices from companies like Apple and Samsung will offer a more polished interface, fewer bugs, and better long-term performance. This perceived value translates directly into purchase decisions, with buyers willing to pay more for peace of mind and quality, further driving premium smartphone market growth.

Manufacturer Strategies Fueling Premium Smartphone Market Growth

Smartphones signify status. Owning a high-end phone from renowned brands conveys luxury and social validation, driving premium sales and luxury mobile expansion.

Apple’s iPhone and Samsung’s Galaxy series cultivate exclusivity. These devices, seen as fashion accessories and status symbols, reflect personal branding. Premium build reinforces premium smartphone market growth.

Marketing focuses on the aspirational lifestyle of owning a flagship device. Emotional appeal and social validation influence purchasing. Owning the latest conveys success, crucial for expensive phone demand and high-end phone trends.

Strategic Partnerships Accelerating High-End Phone Trends

Extended longevity and software support justify premium smartphone prices. With longer ownership, devices must remain relevant for years, accelerating high-end phone trends.

Manufacturers offer longer software support and future-ready hardware for premium smartphone market growth. Samsung and Google commit to seven years of updates for flagship devices.

Apple’s long-term iOS support provides peace of mind. Regular updates for expensive investments enhance user experience and improve resale value for premium smartphones.

Longevity boosts resale value, reducing total ownership cost for a premium phone. Future-ready hardware handles evolving demands, a key differentiator bolstering premium segment increase.

The Global Premium Landscape: Leaders in Premium Smartphone Market Growth

The sustained premium smartphone market growth isn’t accidental. It stems from clever, sophisticated strategies employed by manufacturers and partners to maximize revenue, cultivate brand loyalty, and create compelling value propositions beyond the device itself.

Manufacturers now prioritize sales value over sheer unit volume. In today’s mature market, maximizing ASP and profit margins per device is paramount. Flagship models, though fewer, generate substantial revenue. Companies heavily invest in high-margin premium devices, strengthening their financial health. Leaders like Apple and Samsung excel, leveraging flagships to dominate premium mindshare and revenue, driving premium smartphone market growth.

The Rise of New Frontiers for Premium Smartphone Market Growth

A crucial factor involves ecosystem partnerships, vital in some markets for premium smartphone market growth. In regions like the Middle East and Africa, telecommunication companies and retailers bundle premium devices with enticing service subscriptions, extended warranties, and other valuable additions.

These layered offerings—featuring high-data plans, streaming services, or accessories—effectively draw customers into a larger ecosystem. Consider a new Samsung Galaxy phone with a multi-year contract, premium data, and exclusive content. This makes the initial purchase more attractive by spreading costs and boosting perceived value of the high-end device. By embedding phones within comprehensive service offerings, manufacturers and carriers build lasting customer relationships, solidifying demand for premium pricing and luxury mobile expansion.

The Nuance of Value in Driving Premium Smartphone Market Growth

The global premium smartphone market presents diverse regional dynamics. Economic strength, cultural preferences, and infrastructure development significantly shape consumer demand and manufacturer strategies worldwide. Understanding these regional differences provides deeper insight into the market’s overall direction and premium smartphone market growth.

North America and Europe consistently drive the premium segment increase. These regions feature strong purchasing power, established retail networks, and high demand for advanced technology. Consumers readily adopt innovations and upgrade to the latest models. Apple and Samsung largely dominate market share, compelling manufacturers to continually innovate and deliver cutting-edge features that justify premium prices.

Asia also presents a dynamic premium landscape. South Korea and Japan consistently report the highest ASPs, reflecting their tech-savvy populations’ strong appetite for innovation. These markets serve as testing grounds for new technologies like advanced foldable phones, which further boost ASPs. The United States and the United Kingdom also rank highly globally for ASP, reinforcing strong expensive phone demand within these mature Western economies.

Sustainability and Personalization: Key to Future Premium Smartphone Market Growth Through Premium Smartphone Market Growth

China rapidly becomes a powerhouse in the premium segment, projected for 24% global share in 2024. Growth stems from its expanding middle class and competitive domestic market. While Apple remains strong, local champions like Huawei, Xiaomi, and Oppo increasingly launch premium devices, tailored to local preferences, furthering premium smartphone market growth.

Emerging markets (India, Latin America) show explosive growth in their premium segments. India expanded over fivefold since 2020; Latin America grew 2.5 times. Improved economic conditions, rising incomes, and accessible financing fuel this dramatic increase. Samsung and Xiaomi excel here, offering high-end features, driving premium smartphone market growth.

The global premium smartphone landscape is multifaceted. It blends Apple/Samsung dominance in Western markets with fierce Chinese competition in Asia, and untapped potential in developing economies. Each region uniquely contributes to premium smartphone growth, driven by economic, technological, and cultural factors, fueling high-end phone trends.

The Future of Premium: Sustaining High-End Phone Trends

The smartphone market exhibits a fascinating dual trend. Premium prices continue to soar, and the high-end segment enjoys sustained growth. Yet, “flagship-level features” are increasingly available at more accessible price points, often under £700/$700. This intense competitive tension creates a nuanced landscape, expanding consumer choices and compelling manufacturers to innovate across all price brackets, sustaining high-end phone trends.

Several factors drive this phenomenon. As core technologies mature and component costs decrease, features once exclusive to the most expensive flagships now trickle down to more budget-friendly models. Modern phones below the traditional premium threshold offer high refresh rate AMOLED displays, advanced multi-lens camera systems, and powerful processors. Consequently, a broader segment of the population can now access premium-like smartphone experiences.

Brands like Xiaomi, OnePlus, and Google’s Pixel A-series exemplify this strategic positioning. These companies frequently undercut expected flagship pricing from competitors such as Apple and Samsung, yet deliver comparable specifications and user experiences. Xiaomi, for instance, has built a reputation for providing impressive specs at prices that significantly challenge traditional flagships. Similarly, OnePlus pioneered the “flagship killer” concept, offering top-tier performance at aggressive prices, influencing high-end phone trends.

The Future of Premium: What’s Next for Luxury Mobile Expansion?

This competitive dynamic forces manufacturers to deliver maximum value. It pressures established premium players to continuously innovate, justifying higher prices with unique, cutting-edge features. These might include advanced foldable technology or proprietary AI silicon not easily replicated at lower costs. Without relentless innovation, ultra-premium device value diminishes, impacting luxury mobile expansion.

Crucially, “affordable flagships” don’t negate overall premium smartphone market growth. Instead, this trend broadens the “premium experience” across price tiers. Budget-conscious consumers seeking high performance find excellent options without compromising quality, benefiting from the premium segment increase.

A substantial market portion still prioritizes the latest innovations, brand prestige, and best build quality/software support. These consumers pay a premium for devices like iPhone Pro Max or Samsung Galaxy S Ultra. The “flagship-level features at lower price points” segment caters to a different user intent, balancing performance with cost. This niche coexists with strong demand for ultra-premium devices, affirming expensive phone demand.

The Future of Premium: What’s Next for High-End Smartphones?

The premium smartphone market is evolving towards deeper intelligence, immersive experiences, and sustainability. As devices become indispensable, consumers demand enhanced capabilities, extended longevity, and ethical manufacturing. These expectations influence future pricing and buying habits for high-end phone trends.

A major transformation involves on-device AI. While current flagships use AI for camera/performance, future premium phones will offer pervasive, personalized AI. Imagine devices anticipating needs, managing tasks, and providing real-time assistance without cloud connection. Dedicated AI co-processors will enable complex generative AI directly on-device, boosting privacy/speed, revolutionizing the interface.

Camera technology will advance rapidly, moving beyond megapixels to revolutionary computational photography. Expect sophisticated low-light performance, cinematic video, and novel sensor technologies. Augmented reality (AR) will integrate further, creating immersive visual experiences for premium smartphone market growth.

Widespread adoption of foldable phones represents another defining trend for luxury mobile expansion. As manufacturing and display tech improve, foldables (e.g., Samsung Galaxy Z Fold/Flip) will gain mainstream appeal. Future iterations will be thinner, lighter, more durable, and potentially more affordable. Innovations in hinge/display materials will resolve longevity concerns, solidifying foldables as a robust alternative. New form factors like rollable screens could emerge.

Sustainability and Personalization at the Core

Sustainability and repairability become significant premium features, crucial for premium smartphone market growth. With environmental consciousness growing, manufacturers highlight recycled materials, energy-efficient components, and replaceable parts as key selling points for high-end devices. Brands offering robust repair programs and extended product lifecycles gain a competitive edge, aligning with desires for longevity and responsible consumption. This ethical dimension adds value to premium pricing.

Personalization and customization take center stage. Beyond cosmetic options, premium phones may offer deeper hardware and software customization, allowing users to tailor devices more extensively (e.g., modular components). The drive for seamless integration across connected ecosystems (wearables, smart home, vehicles) intensifies, establishing the premium smartphone as the intelligent central hub.

Future ASP trends are upward. Integrating advanced AI, next-gen display tech, and sustainable manufacturing elevates production costs. This balances with stronger value retention; devices designed to last longer and maintain resale value mitigate overall ownership cost. The future of premium smartphones promises powerful, intelligent, adaptive, and sustainable companions, continuously redefining possibilities, driving further premium smartphone market growth.

Frequently Asked Questions About Premium Smartphone Trends

Q1: Why are premium smartphones so expensive?

Premium smartphones command higher prices due to cutting-edge technologies like advanced AI processors, high-resolution multi-lens camera systems, and sophisticated displays (including foldables). Manufacturers also use premium materials for enhanced durability and design. Additionally, extensive research/development, longer software support, brand prestige, and strategic marketing contribute to their higher cost.

Q2: Are premium smartphones worth the higher price?

For many consumers, premium smartphones are worth the investment. They offer superior performance, better camera quality, extended battery life, and longer software update support. This ensures the device remains relevant and functional for several years. This longevity, coupled with an exceptional user experience and often better resale value, can justify the initial higher outlay, especially for heavy users.

Q3: Which brands dominate the premium smartphone market?

Apple and Samsung are the dominant players in the global premium smartphone market, consistently leading in sales and market share with their iPhone and Galaxy S/Z series, respectively. Other significant contenders include Google with its Pixel series. Chinese manufacturers like Huawei (in specific markets), Xiaomi, and OnePlus also compete strongly, often offering devices with premium features at competitive price points.

Q4: How long do people keep premium smartphones?

Consumers are increasingly holding onto their premium smartphones for longer periods. Recent data indicates that 72% of users replace devices that are three years old or more. This trend is driven by improved device longevity, robust build quality, and manufacturers offering extended software support. This makes it viable to use a premium smartphone for three to five years, or even longer.

Q5: What is the average selling price (ASP) of smartphones?

The average selling price (ASP) of smartphones is on an upward trajectory globally. It was approximately $287 in 2024 and is projected to reach nearly $300 in 2025 and close to $330 by 2029. This increase reflects the growing share of premium devices in the market, inflation, rising component costs, and the integration of advanced technologies across all price segments, contributing to premium smartphone market growth.