Examining Samsung Apple market share trends is key to understanding the intensely competitive global technology landscape. These tech giants have fiercely vied for smartphone supremacy for over a decade; indeed, their rivalry is arguably the most iconic in tech. Market dominance, however, constantly fluctuates. Therefore, this article delves into historical shifts and analyzes their defining strategies. Furthermore, we explore innovation battlegrounds and the future trajectory of this high-stakes competition. Ultimately, this intense rivalry drives significant product evolution and benefits consumers.

A Dynamic Duel: Tracing Samsung Apple Market Share Trends

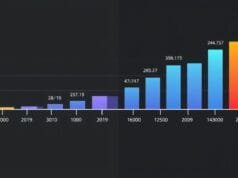

Samsung had previously led global smartphone shipments for twelve consecutive years. Its vast product range, combined with strong market efforts, consistently appealed to a broad user base. This played a key role in its sustained success within the global smartphone rivalry. However, this long reign began to shift significantly in 2023, impacting Samsung Apple market share trends. Apple, the tech giant from Cupertino, briefly took the top spot. Consequently, Apple became the world’s largest smartphone seller by volume, commanding 20.1% of the smartphone market dominance. Samsung, by contrast, held 19.4%.

Apple’s temporary rise in mobile market share was not coincidental; instead, it demonstrated a strategic focus on premium, high-end devices. Demand for flagship iPhones remained exceptionally strong globally, specifically in developed markets. Consumers in these regions, furthermore, often possessed the purchasing power for premium prices. This robust demand significantly fueled Apple’s success and contributed to the shifting Samsung Apple market share trends. Moreover, Apple’s established brand loyalty served as a powerful differentiator in the Samsung vs Apple competition, as did its polished user experience.

The 2024 Rebound: Samsung Reclaims Global Smartphone Rivalry Leadership

However, the market pendulum swung back in early 2024, altering Samsung Apple market share trends. Samsung, consequently, reasserted its top provider position. In Q1 2024, Samsung secured 20.8% of global mobile market share, shipping 60.1 million phones. Apple, in contrast, declined to second place, holding 17.3% and shipping 50.1 million iPhones, reflecting the dynamic global smartphone rivalry.

Apple’s dip, furthermore, stemmed from several concurrent causes impacting its smartphone market dominance. Stronger competition emerged from various Android brands across diverse price segments. Additionally, iPhone shipments to China, a critical market, notably decreased, significantly reducing Apple’s share and influencing overall Apple Samsung sales.

By Q2 2024, Samsung maintained its global lead with 19% mobile market share, while Apple’s share softened to 15.8%. However, 2024 presented a more nuanced picture for the Samsung Apple market share trends. IDC, for instance, indicated Apple was marginally ahead, reporting 18% market share with 225.9 million shipments.

Meanwhile, Counterpoint Research affirmed Samsung’s top spot, reporting 19% of sales with 222.9 million shipments. The difference, indeed, was merely 3 million units. This undeniably highlighted extremely tight Samsung vs Apple competition. Consequently, this close margin emphasizes market volatility and, furthermore, the importance of small shifts in the constantly evolving Samsung Apple market share trends.

Peering into 2025: Future Samsung Apple Market Share Trends and a Shifting Landscape

This intense rivalry, indeed, shows no signs of slowing in 2025, continuing to shape Samsung Apple market share trends. In Q1 2025, Apple again edged out Samsung, seizing global mobile market share leadership with 19%, surpassing Samsung’s 18%. This surge largely stemmed from strong demand for its more affordable iPhone 16e.

Furthermore, strategic growth in key regions contributed significantly to Apple’s smartphone market dominance. These included Japan, India, Southeast Asia, the Middle East, and Africa. This diversified product offering, consequently, allowed Apple to reach new segments and penetrate emerging markets, which traditionally represented Samsung’s core strength.

However, the U.S. market revealed a different trend in Q2 2025. This, undoubtedly, is a crucial battleground in the Samsung vs Apple competition. Samsung gained significantly here, with its market share rising from 23% to 31%. Apple’s dominance, by contrast, declined, falling from 56% to 49%, impacting Apple Samsung sales.

Samsung’s innovative foldable devices primarily drove this shift; specifically, the Galaxy Z Fold and Z Flip series saw significant growth as they appealed to novelty-seekers. In addition, the affordable Galaxy A series also attracted a wider base. This, consequently, underscored Samsung’s diverse product strategy. These evolving Samsung Apple market share trends, therefore, highlight the industry’s dynamic nature and the ongoing global smartphone rivalry.

Clash of Philosophies: Strategies Impacting Samsung Apple Market Share Trends

The Apple and Samsung rivalry extends far beyond mere product specifications. Indeed, it represents a profound “clash of ecosystems.” Furthermore, it showcases deeply divergent business philosophies, as each company approaches the market with distinct perspectives. These are notably evident in their product development and user engagement strategies, significantly shaping Samsung Apple market share trends.

Apple’s Walled Garden: A Strategy for Smartphone Market Dominance

Apple’s “walled garden” strategy, therefore, implies a tightly integrated ecosystem where hardware, software (iOS), and services intertwine seamlessly. This careful control, in turn, delivers a highly polished, consistent user experience. It specifically avoids fragmentation, which is common in open platforms, contributing to its smartphone market dominance. Apple, moreover, prioritizes premium design, intuitive functionality, and robust security. These factors collectively foster exclusivity and reliability among users.

Apple’s marketing, furthermore, often leverages emotional appeal, linking products with an aspirational lifestyle, creativity, and simple sophistication. The company, indeed, emphasizes the holistic experience over technical specifications. Instead, it highlights the perceived “magic” of an Apple device. Brand loyalty is exceptionally strong as a result, often appearing cult-like. This, consequently, translates into sustained demand and higher retention rates, bolstering Apple Samsung sales.

Apple’s innovation, indeed, primarily refines existing technologies, delivering polished, reliable versions. For instance, Face ID revolutionized biometric security, and custom A-series chips consistently set mobile performance benchmarks. This approach perfects implementations; it does not, therefore, prioritize being first to market. Ultimately, this premium position helps maintain high profit margins, reflecting a strategic focus on value over volume in specific segments and influencing overall Samsung Apple market share trends.

Samsung’s Open Innovation: Driving Mobile Market Share Through Diversity

Conversely, Samsung employs a broader, more expansive innovation approach, which often involves greater experimentation. It specifically caters to a wide spectrum of preferences and budgets. This is evident, furthermore, in its diverse product portfolio. This includes ultra-premium flagships like the Galaxy S series, pioneering foldables such as the Galaxy Z Fold/Z Flip, and mid-range/budget devices, notably the Galaxy A series. Thus, Samsung emphasizes diversity and flexible price points, making technology accessible to a larger global audience, boosting its mobile market share.

In stark contrast, Samsung’s marketing frequently highlights technical specifications and innovative features. It proudly displays its industry-leading AMOLED displays, advanced camera systems, and groundbreaking form factors. This direct communication of technological prowess, indeed, attracts consumers who value raw performance and cutting-edge capabilities, vital for Samsung Apple market share trends.

Moreover, a key strength for Samsung is its extensive vertical integration. As a conglomerate, Samsung Electronics controls many aspects of its supply chain, specifically including component manufacturing like memory chips, displays, and batteries, as well as final product assembly. This integration provides distinct advantages, such as better quality control, reduced costs, and rapid production increases. Ultimately, this comprehensive control, coupled with diverse product offerings, enables effective competition and helps maintain global leadership. These distinct strategies, therefore, continue shaping the ongoing Samsung Apple market share trends.

The Innovation Arms Race: Shaping Samsung Apple Market Share Trends

The competition between Samsung and Apple transcends mere market share figures and philosophical differences. Instead, it represents an intense innovation battleground. Both companies, consequently, consistently push technological boundaries. Artificial intelligence (AI), in particular, has become especially critical, as it fundamentally reshapes how these tech giants redefine products and, furthermore, significantly enhances user experiences, influencing Samsung Apple market share trends.

Samsung’s Edge: Innovation Driving Mobile Market Share Gains

Samsung often leads in introducing ambitious new hardware standards. For example, it notably pioneered the mass market for foldable phones, beginning with its Galaxy Z Fold and Galaxy Z Flip series. These devices, indeed, represent a major leap in mobile form factors, offering users a unique blend of smartphone portability and tablet-like screen space. This bold move has been a key driver, boosting Samsung’s recent mobile market share gains in some regions and showcasing its position in the global smartphone rivalry. Moreover, Samsung’s revolutionary AMOLED displays consistently set industry benchmarks, excelling in vibrancy, contrast, and energy efficiency.

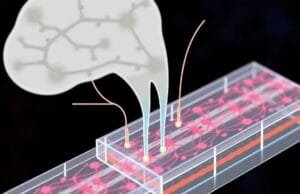

In the realm of AI, Samsung strategically leverages cloud-connected AI, which redefines products and optimizes user experiences. Its “Galaxy AI” suite seamlessly integrates various on-device and cloud-based AI features, significantly enhancing communication, productivity, and creativity. This comprehensive suite, for instance, includes Live Translate for real-time multilingual conversations, Circle to Search with Google for instant information, and advanced photo editing. Samsung, furthermore, often collaborates with key AI partners, embedding AI capabilities across its entire device ecosystem. This, consequently, makes intelligent features widely accessible to users, impacting future Samsung Apple market share trends.

Apple’s Approach: Elevating Smartphone Market Dominance Through Integration

Apple’s AI integration may appear less dramatic than Samsung’s hardware pioneering; however, it is deeply embedded in privacy-centric machine learning. The company, indeed, prioritizes on-device AI processing, which ensures user data remains secure and private. These enhancements continually improve the user experience, applying to Siri and, furthermore, affecting underlying machine learning models that power predictive text and computational photography. Apple’s AI philosophy, therefore, centers on delivering a highly polished, seamlessly integrated, and intelligent experience, primarily enhancing existing functions rather than solely introducing novel ones, reinforcing its smartphone market dominance.

Apple is typically not the first to market with new hardware categories; nevertheless, it is renowned for refining existing technologies and delivering highly polished, user-friendly versions. The company, indeed, is expected to enter the foldable smartphone market around 2026, with rumors suggesting an “iPhone Fold.” If realized, this device would feature a revolutionary “crease-free” display. This, consequently, should greatly intensify competition in premium foldables, further impacting Samsung Apple market share trends. Such a move would demonstrate Apple’s readiness to eventually adopt new form factors on its own terms, complete with its signature emphasis on design and refinement.

Beyond the Duopoly: Geographic Pressures on Samsung Apple Market Share Trends

Beyond AI and foldables, both companies actively explore other emerging technologies that will define the next smartphone generation. Augmented Reality (AR) and Virtual Reality (VR) integration, specifically, represent key battlegrounds, applicable either directly into smartphones or via sophisticated peripherals. These innovations, moreover, promise expanded device utility and deeply immersive experiences. As these technologies mature, their implementation will undoubtedly become a critical differentiator in the global smartphone rivalry.

Furthermore, advancements in battery technology are crucial areas of focus, including faster charging and longer life. In addition, novel sensor technologies are being explored. Ultimately, this relentless pursuit of innovations ensures that Samsung Apple market share trends will remain inextricably linked. Their ability to surprise and delight consumers with truly advanced and user-friendly devices, indeed, will be key to maintaining smartphone industry leadership.

Geographic Dominance: How it Shapes Mobile Market Share

The narrative often focuses intensely on the direct Samsung vs Apple competition. Their rivalry, however, unfolds within a complex global market. This market is significantly influenced by unique geographic preferences and, moreover, faces a rising tide of external competitors. These multifaceted factors, consequently, significantly shape both companies’ strategies and, indeed, impact their overall mobile market share performance.

The Road Ahead: Future Samsung Apple Market Share Trends and Smartphone Supremacy

Apple traditionally maintains a formidable presence in North America and other developed markets. Among high-income consumers, particularly in Western economies, Apple consistently excels, leading in premium phone sales. Its aspirational brand image and robust ecosystem, indeed, strongly appeal to this demographic. Here, consumers often prioritize brand loyalty and perceived status; furthermore, they value a consistent, high-quality user experience, all of which Apple consistently delivers, impacting Samsung Apple market share trends.

Samsung, in contrast, boasts a much wider global reach. It holds a very strong position in emerging markets, including Asia, Africa, and Latin America. It is also robustly positioned in more budget-conscious segments globally. Its diverse product portfolio, moreover, encompasses many price points. This, consequently, allows Samsung to capture a larger share of smartphone market dominance in these regions. Samsung’s adaptability, furthermore, contributes significantly to its widespread presence, as it willingly tailors devices for specific regional needs. Ultimately, this geographic segmentation often leads to varied market share figures, which depend on the region analyzed, thus profoundly impacting overall Samsung Apple market share trends.

Frequently Asked Questions About Samsung Apple Market Share Trends

Both Samsung and Apple presently face growing pressure from new, formidable Chinese smartphone brands. Companies like Xiaomi, Oppo, and Transsion (including Tecno and Infinix) have gained traction quickly, especially in the budget and mid-range sectors. These brands, indeed, offer compelling features at aggressively competitive prices. This, consequently, challenges Samsung’s historical dominance in accessible segments. Their strong growth, particularly in emerging markets, has created a multi-polar environment. This, moreover, forces Apple and Samsung to innovate not only at the high end but also to consider more affordable offerings. The success of Apple’s “iPhone 16e” and Samsung’s “Galaxy A series” in 2025, furthermore, proves this point, highlighting their awareness of this intensifying competitive pressure on Samsung Apple market share trends.

Q1: Why did Apple briefly surpass Samsung in Global Smartphone Rivalry in 2023?

Beyond direct market competition and the rise of new rivals, the Samsung-Apple rivalry experiences other intense pressures. This, furthermore, includes prolonged, high-profile legal battles centering on patent infringement. Both companies, indeed, have frequently accused each other of copying designs and technologies. Such legal skirmishes are costly and time-consuming; nevertheless, they underscore the immense value of intellectual property in the technology sector.

Moreover, aggressive marketing campaigns distinctly mark their competition. Samsung, for instance, often employs playful jabs at Apple in its advertisements, humorously highlighting perceived iPhone shortcomings. Conversely, it celebrates its own innovative features, including larger screens or stylus integration, which Samsung adopted long before Apple. Ultimately, these marketing tactics aim to sway consumer perception and, furthermore, carve out a distinct brand identity in an increasingly crowded market. All these diverse pressures, indeed, collectively contribute significantly to the complex and evolving Samsung Apple market share trends.

The Road Ahead: What the Future Holds for Smartphone Supremacy

The fierce Samsung-Apple rivalry, undoubtedly, drives mobile technology innovation, delivering advanced, intuitive, and user-friendly smartphones. Both companies, indeed, relentlessly pursue market leadership and technological superiority, remaining at the forefront of development.

Looking ahead, key areas will define future battlegrounds for smartphone market dominance. Seamless Augmented Reality (AR) and Virtual Reality (VR) integration is crucial, promising expanded device utility and deeply immersive experiences. As these technologies mature, their implementation will become a critical differentiator.

Secondly, AI-powered feature advancements play a pivotal role. Expect sophisticated on-device AI for enhanced privacy and faster processing, alongside deeper cloud AI for advanced services. AI will profoundly personalize experiences, automate complex tasks, and unlock creative possibilities, significantly influencing Samsung Apple market share trends.

Battery technology, moreover, remains a constant concern, receiving significant investment. Breakthroughs are anticipated in longevity, faster charging, and efficient power management. These improvements are vital, supporting powerful hardware and complex software, essential for maintaining mobile market share in the competitive landscape.

Beyond Pure Technology: Sustainability and Ethics

Beyond pure technological prowess, sustainability and ethical practices are increasingly influential, impacting strategic decisions and consumer choices. As environmental concerns rise and social consciousness grows, companies must adapt comprehensively. Firms demonstrating a genuine commitment, furthermore, will gain a competitive edge in the global smartphone rivalry. This includes reducing carbon footprints, ensuring ethical supply chains, and promoting device longevity. Consumers, indeed, increasingly scrutinize product creation, examining repairability and end-of-life impact. This, consequently, adds a new and vital dimension to the competitive landscape.

Ultimately, this fierce competition immensely benefits consumers. It constantly forces both companies to innovate and, furthermore, pushes the boundaries of smartphone capabilities. This dynamic, consequently, accelerates technological advancements, offers wider choices, and leads to better products that cater to diverse needs and preferences. Therefore, the Samsung Apple market share trends will continue to reflect this exciting interplay, showcasing innovation, strategic evolution, and the relentless pursuit of mobile supremacy.

Frequently Asked Questions About Samsung Apple Competition

Q1: Why did Apple briefly surpass Samsung in global smartphone shipments in 2023?

A1: Apple’s brief mobile market share lead in 2023 had a primary driver; specifically, strong global demand for its high-end, premium iPhones. The company’s strategic focus on premium devices saw significant success in developed markets. Consumers there, furthermore, possess higher purchasing power and, consequently, show strong brand loyalty. These factors fueled Apple’s surge in Apple Samsung sales.

Q2: How did Samsung reclaim its lead in early 2024?

A2: Samsung reclaimed market leadership in early 2024 due to several factors impacting Samsung Apple market share trends. For instance, increased competition from various Android brands notably impacted Apple’s sales. Moreover, Apple’s shipments to the crucial Chinese market declined significantly. Samsung, by contrast, maintained strong performance with its diverse product portfolio, including the popular Galaxy series, solidifying its smartphone market dominance.

Q3: What are the main differences in Apple’s and Samsung’s competitive strategies?

A3: Apple employs a “walled garden” strategy, focusing on a tightly integrated ecosystem with emphasis on premium design and a seamless user experience. Its marketing, furthermore, stresses emotional appeal and an aspirational lifestyle. Samsung, conversely, adopts an “open innovation” approach, offering diverse products across many price points and pioneering new hardware, like foldables. Its marketing highlights technical specifications, and it benefits from extensive vertical integration in its supply chain, affecting their long-term mobile market share strategies.

Q4: How is AI shaping the innovation battle between the two companies?

A4: Both companies leverage AI, but with different focuses impacting the global smartphone rivalry. Samsung, on the one hand, integrates cloud-connected AI into “Galaxy AI” features. This, consequently, redefines user experiences and optimizes product offerings, often tied to ambitious new hardware. Apple, however, focuses on privacy-centric machine learning, refining existing features like Siri and delivering highly polished AI enhancements deeply integrated into its ecosystem, often using on-device processing for security.

Q5: What is the significance of foldable phones in the Samsung-Apple rivalry?

A5: Foldable phones, pioneered by Samsung (e.g., the Galaxy Z Fold and Z Flip), have been a key innovation driver. They contributed, consequently, to Samsung’s mobile market share gains in some regions by offering a unique form factor. Apple, meanwhile, is expected to enter the foldable market around 2026 with an “iPhone Fold.” This signals the segment’s growing importance and, moreover, marks a new frontier for their premium competition, further defining Samsung Apple market share trends.