The world is constantly evolving due to technology and economic shifts. As a result, forward-thinking leaders are redefining business models. Adrian Cheng, renowned for his traditional Hong Kong conglomerates, is now spearheading this transformation. He has launched a bold new venture, ALMAD Group Adrian Cheng. This exciting development signals a significant pivot towards digital innovation and high-growth markets.

This article explores ALMAD Group Adrian Cheng’s ambitious strategy and its mission to shape the future economy. First, we will examine the catalysts behind this pivotal shift. Next, we will delve into ALMAD Group Adrian Cheng’s core objectives. Finally, we will consider the implications for anyone interested in the evolving global market. Ultimately, prepare to discover new perspectives on wealth and innovative approaches to business.

The Dawn of a New Era: Adrian Cheng and Evolving Business

The global economy is currently undergoing a significant transformation. Indeed, many legacy industries, once considered unshakeable, now confront unprecedented challenges. Previously, for decades, sectors like real estate were perceived as safe havens for capital and stability. However, their landscape has significantly altered.

Today, rapid technological advancements, evolving consumer behaviors, and novel financial trends are converging. Consequently, these dynamics compel even the most established business leaders to re-evaluate their strategies. Moreover, they must actively seek new opportunities.

Global Commerce Shifts: Context for Adrian Cheng’s ALMAD Group

Consider the pace of global transformation over the past decade. Specifically, digital technologies have profoundly reshaped communication, commerce, and leisure. Thus, this relentless pace of innovation necessitates rapid adaptation for businesses to remain competitive. Furthermore, emerging markets, particularly across Asia, Africa, and the Middle East, are experiencing exponential growth. These regions boast young, digitally savvy populations with a burgeoning demand for novel products and services.

The confluence of technological advancement and burgeoning market demand presents fertile ground for new ventures. Therefore, comprehending these fundamental shifts is crucial to understanding Adrian Cheng’s strategic redirection. This context is particularly pertinent to ALMAD Group Adrian Cheng’s core focus.

Lessons from Legacy: Informing ALMAD Group’s Strategy

For generations, prominent families like the Chengs established vast business empires. Typically, these conglomerates concentrated on real estate development, retail, and manufacturing. Such traditional ventures, therefore, demanded substantial capital, long-term strategic planning, and deep local market expertise. However, recent years have introduced significant headwinds. For instance, Hong Kong’s property market has confronted considerable challenges. This has resulted in increased leverage and diminished profitability for numerous developers.

These challenges underscore the necessity for businesses to be agile and diversified. Indeed, relying solely on traditional approaches can be precarious in rapidly shifting landscapes. This context clarifies why a visionary leader like Adrian Cheng has chosen an entirely new trajectory. In fact, he divested from his family’s legacy business interests. This move is not merely an adaptation; it is about actively constructing for the future. This embodies a core tenet of ALMAD Group Adrian Cheng’s mission.

Adrian Cheng’s Bold Vision: Introducing ALMAD Group Adrian Cheng

Adrian Cheng’s decision to launch ALMAD Group transcends the mere establishment of a new company; it signifies a profound philosophical shift. Instead, after stepping away from New World Development and his family’s legacy business interests, Cheng intensely focused on the future. His objective is to forge an enterprise that thrives on innovation. This enterprise must also anticipate and address the evolving needs of future generations, as envisioned by ALMAD Group Adrian Cheng.

ALMAD Group, inaugurated in September 2025, is headquartered in Hong Kong. Significantly, this strategic location places ALMAD Group Adrian Cheng at the nexus where global capital converges with the burgeoning Asian digital economy. Cheng himself serves as the company’s founder and CEO.

Adrian Cheng’s ALMAD Group: A Philosophy for the Next Generation

Adrian Cheng articulates ALMAD Group’s mission: “to build what the next generation needs and to shape a future economy filled with possibilities.” This vision underscores his profound understanding of evolving demographics and emerging consumer desires. Specifically, he recognizes that Gen Z and Gen Alpha will be the driving force of the economy for the next two decades. Moreover, these generations possess distinct values, aspirations, and levels of technological fluency compared to their predecessors. This insight is central to ALMAD Group Adrian Cheng’s operational philosophy.

Thus, ALMAD Group Adrian Cheng is not merely trend-following. Instead, it aims to make early-stage investments in sectors that genuinely resonate with and empower these digitally native younger demographics. In essence, the objective is to create a synergistic ecosystem of services and experiences. These offerings must be innovative and profoundly relevant to their lives.

Hong Kong: A Digital Hub for Adrian Cheng’s ALMAD Group

Hong Kong’s selection as ALMAD Group Adrian Cheng’s headquarters is a highly astute move. Historically, Hong Kong has served as a pivotal bridge between East and West. In addition, it boasts robust financial infrastructure and transparent regulatory frameworks. Crucially, the city is rapidly emerging as a premier hub for digital assets and nascent Web3 innovations.

Hong Kong’s progressive regulatory stance, particularly concerning stablecoins and virtual assets, has significantly streamlined the establishment of digital businesses. Indeed, these clear guidelines attract both talent and capital. Consequently, this positions Hong Kong as an ideal base for a firm like ALMAD Group Adrian Cheng. Its strong focus on digital and virtual assets aligns perfectly with this environment, offering a stable yet innovative ecosystem for pioneering ventures.

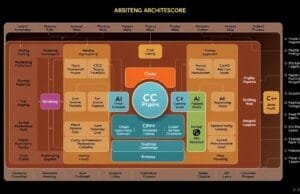

ALMAD Group’s Three Pillars: Charting the Future Economy

ALMAD Group Adrian Cheng’s investment approach is robust. Specifically, it is structured around three distinct yet interconnected pillars. These pillars are designed to capitalize on growth opportunities within rapidly expanding emerging markets and the evolving digital landscape. By synergizing cultural experiences with advanced technology, ALMAD Group Adrian Cheng aims to cultivate a unique portfolio of ventures. Ultimately, these investments are poised to exemplify the essence of the “future economy.”

Let’s examine each of these core investment areas in detail. Here, we will explore their potential and significance, illuminating how each pillar contributes to Adrian Cheng’s overarching vision for ALMAD Group Adrian Cheng.

ALMAD Group’s Pillar 1: Transforming Emerging Markets

The first pillar is dedicated to transformative industries within high-growth emerging markets. To this end, ALMAD Group Adrian Cheng plans to invest in sectors that present significant business opportunities. These sectors also possess the capacity to shape society and cater to the evolving demands of younger demographics. Thus, primary geographical focuses include mainland China, the ASEAN bloc in Southeast Asia, and the dynamic markets of the Middle East.

These regions are characterized by large populations. Furthermore, they exhibit increasing disposable income and a strong appetite for modern amenities and novel experiences. This demographic and economic trend is highly significant for ALMAD Group Adrian Cheng.

Cultivating Culture, Entertainment, and Sports

ALMAD Group Adrian Cheng has a keen interest in culture, entertainment, and sports. Indeed, these industries are experiencing rapid growth in emerging markets. They are propelled by digitally native youth seeking novel content and experiences. Consider, for instance, the burgeoning popularity of local sports franchises, the proliferation of streaming services, and the global appeal of cultural events. Investment in this sector leverages inherent human desires for connection, excitement, and self-expression.

This strategic focus also encompasses media. For instance, digital platforms are reshaping content consumption. Consider the vast potential of immersive experiences, interactive media, and innovative storytelling formats. These can captivate global audiences.

Innovating Healthcare and Commercial Management

Beyond entertainment, ALMAD Group Adrian Cheng also identifies significant potential in healthcare and commercial management. In these regions, emerging markets frequently present unique challenges and opportunities in these sectors. For instance, there is a growing demand for accessible and high-quality healthcare services. Technological advancements such as telemedicine and AI-driven diagnostics are often instrumental in addressing this need.

ALMAD Group Adrian Cheng’s Strategic Investment Areas

In commercial management, the objective is to optimize operational efficiency and enhance customer experience across various enterprises. Specifically, this will likely involve leveraging data analytics and intelligent technologies. Ultimately, these investments aim to improve quality of life and foster robust functionality in crucial sectors. This aligns with ALMAD Group Adrian Cheng’s broader strategic vision.

Pioneering Cultural Tourism

Cultural tourism represents another significant domain for ALMAD Group Adrian Cheng. Naturally, as economies mature, there is an increasing inclination among populations to travel and engage with diverse cultures. ALMAD Group Adrian Cheng aims to invest in projects that enhance the cultural tourism landscape. These investments could include unique destinations, experiential retail concepts, or immersive cultural events. This strategy aligns perfectly with the ethos of K11, which will be discussed further shortly.

These investments transcend mere financial returns. Instead, they are designed to cultivate vibrant communities and foster memorable experiences that attract engagement. Thus, one can observe how digital connectivity can seamlessly integrate with physical spaces. This integrated approach is central to ALMAD Group Adrian Cheng’s strategy.

ALMAD Group’s Pillar 2: Pioneering Digital Assets

The second pillar delves deeply into the digital realm. Namely, it focuses on the transformative potential of Web3, blockchain, and digital assets. This sphere represents the convergence of the future of finance and ownership with daily life. ALMAD Group Adrian Cheng actively seeks investments leveraging these technologies. In doing so, its clear objective is value creation.

Overall, this domain signifies a definitive departure from traditional business paradigms. Instead, it emphasizes pioneering innovations at the technological forefront. This underscores a core value for ALMAD Group Adrian Cheng.

Embracing Web3 and Blockchain Applications

Web3 is frequently heralded as the internet’s next evolutionary phase. It promises a decentralized online experience where users possess sovereignty over their data. Specifically, ALMAD Group Adrian Cheng plans to invest in applications predicated on this paradigm. These include everything from decentralized finance (DeFi) to decentralized autonomous organizations (DAOs). Blockchain, the underlying technology, offers robust security and transparent record-keeping. Consequently, this makes it ideal for a multitude of applications.

These investments could span gaming, social media, and innovative digital identity solutions. Thus, ALMAD Group Adrian Cheng is positioning itself at the vanguard of digital transformation.

Real-World Asset (RWA) Tokenization

One of the most compelling frontiers is the tokenization of real-world assets (RWA). Essentially, this involves converting tangible assets, such as property, art, or commodities, into digital tokens on a blockchain. This process can unlock liquidity, democratize investment access, and introduce novel ownership models. ALMAD Group Adrian Cheng anticipates a potential $2 trillion RWA tokenization market within emerging economies.

ALMAD Group Adrian Cheng’s Strategic Digital Asset Investments

This sophisticated digital asset paradigm enables fractional ownership, enhanced transferability, and greater transparency. For example, imagine fractional digital ownership of a skyscraper or a valuable artwork. This innovation democratizes access to previously illiquid or exclusive investments, broadening the investor base. ALMAD Group Adrian Cheng facilitates the realization of these opportunities.

Furthermore, blockchain offers robust mechanisms for rights management. Indeed, this is particularly salient in the entertainment and media sectors. For example, content creators can leverage blockchain to meticulously track intellectual property ownership, usage, and royalties with unparalleled precision. This, therefore, can foster equitable compensation and novel monetization avenues for artists and producers.

By leveraging blockchain for these objectives, ALMAD Group Adrian Cheng seeks to establish more equitable and efficient systems within the entertainment ecosystem. Hence, this directly connects to their investments in culture and media. Ultimately, it ensures creators are appropriately remunerated in the digital age.

Adrian Cheng’s ALMAD Group: Globalizing K11 by AC

The third pillar centers on the global expansion of Adrian Cheng’s renowned cultural brand, K11 by AC. Specifically, K11 is celebrated for its seamless integration of art, retail, and culture. It creates experiential retail destinations. This brand transcends the conventional mall concept; it is a cultural ecosystem designed to foster engagement and creativity. Indeed, this forms a pivotal component of ALMAD Group Adrian Cheng’s strategy.

Expanding the K11 Ecosystem

K11 by AC already boasts significant recognition, particularly across mainland China. However, ALMAD Group Adrian Cheng plans to further amplify this concept globally. It aims to introduce its unique blend of art, design, and retail to new international markets. This expansion is not solely about opening new physical spaces; rather, it’s about disseminating a philosophy of cultural retail. This philosophy resonates with consumers globally.

The objective is to establish destinations that are not only commercially viable but also significant cultural landmarks. Moreover, these venues offer curated, distinctive experiences. Such offerings distinctly differentiate them from conventional retail environments.

Global Expansion of K11 and Anime IP Business

Experience 11 and Anime IP Business

Integral to this expansion for ALMAD Group Adrian Cheng is “Experience 11,” encompassing the Anime IP business. Indeed, anime and manga have evolved into global cultural phenomena. They transcend national borders, captivating audiences across all demographics. Consequently, ALMAD Group Adrian Cheng is actively scaling its Anime IP business, which is already demonstrating strong performance across mainland China and the Middle East.

This venture capitalizes on the immense popularity of animated content and characters. In addition, it generates new monetization streams through merchandise, exclusive events, and immersive experiences. Ultimately, it directly taps into the significant engagement of Gen Z and Gen Alpha consumers. This represents a critical focus for ALMAD Group Adrian Cheng.

ALMAD Group Adrian Cheng Expands K11’s Global Cultural Ecosystem

Finally, ALMAD Group Adrian Cheng will globalize the luxury Gentry Club concept. This exclusive members-only club offers curated experiences and networking opportunities for affluent clientele. It blends a sophisticated lifestyle with cultural enrichment. Thus, it provides a distinctive milieu for high-net-worth individuals who appreciate art, innovation, and bespoke services.

This initiative enhances the K11 brand’s appeal to discerning high-end customers. Moreover, it further integrates luxury with culture and community. In the end, this cultivates a comprehensive portfolio of lifestyle offerings.

https://www.youtube.com/watch?v=gquvVrWMU

The Strategic Advantage: Why ALMAD Group Adrian Cheng is Positioned for Success

Adrian Cheng’s pivot into digital domains and emerging markets is not a blind leap. Instead, it represents a meticulously calculated strategic maneuver. Consequently, his proven investment track record, coupled with a keen understanding of evolving global markets and regulatory landscapes, provides ALMAD Group Adrian Cheng with a distinct competitive advantage. Indeed, this new venture leverages both historical expertise and foresight into future trends.

To clarify, let’s examine the factors that position ALMAD Group Adrian Cheng for significant success in these nascent domains.

A Proven Track Record: Lessons from C Capital for ALMAD Group

Before ALMAD Group, Adrian Cheng demonstrated his prowess as an early-stage investor with his previous firm, C Capital (formerly C Ventures). Initially, established in 2017, C Capital rapidly cultivated an impressive portfolio of highly successful ventures. Specifically, these included notable entities such as Xiaohongshu, a prominent Chinese social e-commerce platform, and Shein, a global fast-fashion retailer.

Further significant investments included Lalamove, a logistics and delivery service; XPeng, an electric vehicle manufacturer; and Micro Connect, a financial technology platform. Additionally, C Capital also invested in leading Web3 and blockchain firms like Animoca Brands, Hex Trust, and Consensys. This track record unequivocally demonstrates Adrian Cheng’s acumen in identifying and nurturing nascent technologies and high-growth enterprises. His extensive venture capital experience, therefore, provides a formidable foundation for ALMAD Group Adrian Cheng’s ambitious objectives.

Tapping into Untapped Potential: Emerging Market Dynamics for ALMAD Group

Emerging markets present unparalleled growth opportunities. Indeed, their large, increasingly digitally connected youth populations constitute a vast consumer base. Consequently, ALMAD Group Adrian Cheng’s focus on these regions for transformative industries and RWA tokenization is highly strategic.

Consider the following market insights relevant to ALMAD Group Adrian Cheng:

| Market Opportunity | Description |

|---|---|

| RWA Tokenization | Potential $2 trillion market in emerging economies through institutional-grade digital asset innovation. This unlocks liquidity for illiquid assets. |

| Digital Entertainment | Venture funding in Asia-Pacific for digital entertainment rose by 35% last year, indicating strong investor confidence and consumer demand in the sector. |

| Crypto Adoption | Emerging markets like Nigeria and Argentina show increased crypto adoption, driven by factors such as high inflation rates and the need for efficient remittances. |

These statistics underscore the compelling opportunities ALMAD Group Adrian Cheng is addressing. In other words, they highlight both the imperative for and the receptiveness to innovative financial and entertainment concepts within these regions.

Regulatory Clarity and Market Growth: Hong Kong’s Digital Leap for ALMAD Group Adrian Cheng

Hong Kong’s proactive regulatory stance on digital assets is a crucial enabler for ALMAD Group Adrian Cheng. For one, clearer guidelines for stablecoins and virtual assets have fostered confidence and attracted significant institutional interest. This regulatory environment, therefore, helps mitigate investor risks. Moreover, it encourages legitimate enterprises to operate within the digital asset space.

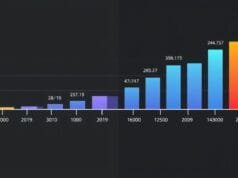

Indeed, the growth trajectory is evident. Hong Kong’s digital asset transactions conducted by banks reached HK$26.1 billion in the first half of 2025. Significantly, this represents a substantial 233% increase year-on-year. This rapid expansion not only solidifies Hong Kong’s position as a digital asset hub but also cultivates a dynamic environment conducive to ALMAD Group Adrian Cheng’s Web3 and RWA tokenization projects.

Decoding the Future: ALMAD Group Adrian Cheng’s Impact

Adrian Cheng’s establishment of ALMAD Group is more than a mere business endeavor. Instead, it conveys a profound statement regarding future investment paradigms and economic development. Consequently, this initiative carries broader implications. It could fundamentally reshape the interaction between legacy industries and the digital realm and may influence other major corporations. It posits a novel approach to capital allocation and value creation, outlining ALMAD Group Adrian Cheng’s strategic blueprint.

Let’s delve into the potential far-reaching impact ALMAD Group Adrian Cheng could have on the global economy.

ALMAD Group’s Hybrid Model: Redefining Investment

ALMAD Group Adrian Cheng exemplifies a novel hybrid investment model. Specifically, it seamlessly integrates traditional investments in large-scale cultural and experiential projects, while also converging with cutting-edge digital asset innovations. This philosophy recognizes that the future economy is neither solely digital nor purely physical, but rather a robust fusion of both.

By integrating investments in real-world transformative industries with Web3 and RWA tokenization projects, ALMAD Group Adrian Cheng aims to construct a synergistic ecosystem where all components function cohesively. For instance, blockchain technology could optimize the operational efficiency and revenue generation of cultural tourism projects. Likewise, digital assets could provide novel funding mechanisms for entertainment ventures. This integrated strategy, therefore, offers a robust framework for navigating the complexities of contemporary markets.

ALMAD Group’s Influence: A New Wave for Traditional Players

The strategic pivot by such a prominent figure from a legacy industrial family sends a powerful signal to other major corporations. Rather, it suggests that venturing into digital enterprises and emerging markets is not merely an option, but a prudent and necessary step for long-term sustainability and relevance. This shift, therefore, could catalyze a new wave of cross-border capital and innovation flows, originating from traditionally focused companies, following the vanguard set by ALMAD Group Adrian Cheng.

Adrian Cheng’s initiatives may prompt established companies to diversify their investment portfolios. In short, they might also explore blockchain integration or invest in digital infrastructures. Ultimately, his blueprint, exemplified by ALMAD Group Adrian Cheng, could accelerate sweeping transformations across numerous industries, facilitating the more rapid adoption of novel technologies and business methodologies across various sectors.

ALMAD Group Adrian Cheng: Challenges and Opportunities Ahead

Adrian Cheng’s vision for ALMAD Group is undeniably ambitious and future-oriented. However, every nascent and audacious venture confronts unique challenges. Therefore, comprehending these potential hurdles, alongside the myriad opportunities, provides a more comprehensive outlook on what’s to come. For observers or potential collaborators, this offers valuable context regarding ALMAD Group Adrian Cheng.

ALMAD Group Adrian Cheng’s trajectory will necessitate strategic agility, decisive execution, and continuous adaptation within dynamic markets.

ALMAD Group’s Path Forward: Balancing Ambition with Execution

For instance, some market analyses have noted a scarcity of detailed information regarding ALMAD Group Adrian Cheng’s precise funding mechanisms. They also highlight a lack of clarity on the scale of its investments or a definitive current project roster. While Cheng’s vision is compelling, any ambitious enterprise’s success ultimately hinges on its ability to execute its objectives, translating grand concepts into tangible, profitable realities.

However, Adrian Cheng’s proven track record with C Capital lends significant credence to his execution capabilities. Indeed, there, he successfully identified and scaled numerous nascent ventures. His prior successes demonstrate a sophisticated understanding of investment dynamics and venture nurturing. ALMAD Group Adrian Cheng’s launch amidst a challenging property market and clarifying digital asset regulations suggests a deliberate, strategic move rather than a rushed one, which further instills confidence in its meticulously planned approach.

ALMAD Group: Building an Ecosystem for Tomorrow

The true opportunity for ALMAD Group Adrian Cheng lies in its capacity to construct a cohesive, integrated ecosystem. Namely, this ecosystem harmonizes its three core pillars. Imagine a cultural tourism destination (Pillar 1) that leverages real-world asset tokenization for funding or fractional ownership (Pillar 2), and also features K11’s distinctive retail experiences and Anime IP (Pillar 3). Thus, such synergistic integration could yield truly unique and compelling offerings.

By strategically targeting Gen Z and Gen Alpha, ALMAD Group Adrian Cheng is investing in the consumers of tomorrow. Moreover, these digitally native consumers prioritize authenticity, experiences, and purpose. Furthermore, this long-term perspective enables the group to capture profound societal shifts. Indeed, it transcends ephemeral trends, aiming to redefine how individuals live, work, and interact with the world.

Crafting a Legacy: ALMAD Group Adrian Cheng’s Place in the Future

Adrian Cheng’s ALMAD Group signifies more than a nascent enterprise. Indeed, it is an audacious declaration regarding the future of global commerce. Instead, Adrian Cheng has judiciously pivoted his focus from the inherent challenges of traditional property development. He now targets the high-growth frontiers of digital innovation and emerging markets, forging a legacy of strategic vision and transformative impact.

The firm’s focus on transformative industries in emerging markets, leadership in digital assets, and global expansion of the K11 brand, together, forms a robust and integrated strategy for ALMAD Group Adrian Cheng. This plan is further designed to harness the burgeoning demand among younger demographics. Ultimately, it redefines the convergence of finance, culture, and technology.

This astute strategic shift transcends mere adaptation. Instead, it is about actively contributing to the co-creation of the future economy. Backed by a proven track record of identifying successful early-stage investments, ALMAD Group Adrian Cheng is optimally positioned to lead this charge. Furthermore, it leverages Hong Kong’s burgeoning role as a digital asset hub.

What do you think will be the biggest future challenge or chance for leaders in digital assets and new markets, like ALMAD Group Adrian Cheng?