Imagine a vault, built with the strongest steel. Furthermore, it has the most impenetrable locks known to humankind. This vault holds your life savings; indeed, it contains your personal identity. Moreover, it secures the trust you place in the financial system. For decades, the digital equivalent of this vault has been protected by encryption, which is an invisible shield of complex mathematics. However, a seismic shift is underway, driven by the emergence of quantum processors. Consequently, this creates a quantum encryption threat that could fundamentally redefine cybersecurity.

This isn’t a distant science fiction scenario; rather, it’s a looming reality. Therefore, it demands our attention today. The question isn’t if quantum computers will break our current encryption; instead, the question is when. So, what steps must we take? Ultimately, we must safeguard our financial future. Consequently, your bank account is on the line. Furthermore, vulnerability extends to your online transactions. Digital privacy is also at risk. This technological revolution, therefore, unfolds now.

The Invisible Shields: How Your Money Stays Safe (For Now)

Every time you log into online banking, algorithms work. Likewise, they also work when you swipe your card or send an email. Indeed, these complex mathematical algorithms work tirelessly behind the scenes. They are the unsung heroes of our digital lives. Specifically, they scramble your data into an unreadable format. Then, they reassemble it securely for the intended recipient.

The Pillars of Modern Encryption

Sophisticated cryptographic standards, consequently, lie at the heart of modern cybersecurity. For instance, public-key encryption methods form its backbone. These, for example, include RSA and Elliptic-Curve Cryptography (ECC). Ultimately, they secure communications and transactions. Specifically, they rely on mathematical problems that are incredibly difficult. Indeed, even the most powerful traditional supercomputers cannot solve them quickly; in fact, solving them within a reasonable timeframe is practically impossible. This computational difficulty, therefore, gives us confidence. Moreover, it secures our data. Breaking an RSA key, for instance, requires factoring a massive number, which involves finding its two prime components. Consequently, classical computers would need billions of years for this task.

Symmetric encryption also plays a crucial role. Advanced Encryption Standard (AES), for example, is one such example. It often encrypts bulk data. Its approach is different; nevertheless, it too relies on computational barriers. These consequently protect information from prying eyes. Indeed, these systems have served us well. Therefore, they form the foundation of trust in our digital world.

Where Quantum Computers Come In

Now, enter quantum computers. These are a revolutionary class of machines. Specifically, they leverage the strange rules of quantum mechanics. Classical bits are either 0 or 1; however, quantum bits (qubits) can exist in multiple states simultaneously. This consequently happens through a property called superposition. Qubits can also become “entangled,” which links them regardless of distance. These unique capabilities, therefore, enable quantum computers. Indeed, they perform certain calculations exponentially faster, surpassing any classical machine.

Specifically, two quantum algorithms furthermore pose a direct quantum encryption threat:

- Shor’s Algorithm: Peter Shor developed this breakthrough algorithm. It can efficiently solve integer factorization problems. Moreover, it also solves discrete logarithm problems. These, then, are the exact mathematical foundations upon which RSA and ECC encryption standards are built. Consequently, a sufficiently powerful quantum computer could shatter these protections. Specifically, it would run Shor’s algorithm, making encrypted data instantly readable.

- Grover’s Algorithm: This algorithm speeds up database searches. It is not as catastrophic as Shor’s for public-key encryption; nevertheless, for symmetric encryption like AES, it could halve the key strength. In other words, a theoretically secure 256-bit key would become 128 bits. This, in turn, makes brute-force attacks far more feasible.

This means current mathematical problems, which provide our digital security, could otherwise become trivial. This will happen, consequently, for future quantum machines.

Harvest Now, Decrypt Later: The Silent Data Grab

The “Harvest Now, Decrypt Later” (HNDL) tactic is insidious. Indeed, it is one of the most alarming aspects of the quantum encryption threat. This is not a future concern; rather, it is happening right now. For instance, adversaries are already collecting vast quantities of encrypted data. These include state-sponsored actors, and also sophisticated criminal organizations are involved.

A Time Capsule for Hackers

They are hoarding everything. This, for example, includes confidential financial transactions and intellectual property. Government secrets and personal data are also targeted. They understand they cannot decrypt this information today; however, cryptographically relevant quantum computers (CRQCs) will arrive. These, subsequently, will provide the ultimate decryption key. It’s like collecting encrypted diaries today, knowing that tomorrow a universal translator will be invented. This strategy, therefore, presents a profound long-term risk. Consider this: data needs to remain confidential for decades. For instance, medical records, national security documents, and deeply personal financial histories could also be compromised retroactively.

The implication is chilling. A system may be secure today; however, data transmitted and stored now could be exposed years later. Proactive measures are thus crucial. Indeed, they secure future communications. Moreover, they also protect sensitive information we generate and store now.

The Financial Sector’s High Stakes

Few sectors rely as heavily on robust cryptographic security. Certainly, the financial industry is one such sector. Banks, investment firms, and payment processors depend on it; even emerging blockchain technologies use encryption. This consequently maintains trust and protects assets. Furthermore, it also ensures operational integrity. The potential disruption from a quantum encryption threat, therefore, is staggering.

Vulnerabilities in a Digital Economy

The financial world is a prime target. This is due to the immense value of its data. Encryption safeguards your money in myriad ways. Specifically, consider these examples:

- Customer Data Protection: Your personal and financial information is encrypted. This furthermore includes account numbers, transaction history, and login credentials. Ultimately, it is protected during transmission and storage.

- Secure Transactions: Every online payment relies on cryptographic protocols. Likewise, so do ATM withdrawals or wire transfers. They therefore prevent fraud. Moreover, they ensure authenticity.

- Digital Identity Verification: Multi-factor authentication increasingly uses encryption. Digital signatures and biometric data also do. This consequently confirms your identity.

- Blockchain and Cryptocurrencies: These decentralized ledgers rely heavily on cryptography. Specifically, they use cryptographic hashes and digital signatures. This therefore ensures their integrity and security. However, a quantum attack could unravel their mathematical underpinnings. This ultimately would lead to chaos.

The Cost of Inaction

Compromised encryption in the financial sector could be catastrophic. We’re not just talking about individual data breaches; rather, we mean systemic instability. Imagine, for example, widespread identity theft. Fraudulent transactions could occur on an unprecedented scale. Consequently, public trust in digital banking could completely erode. Such an event could cripple economies, leading to widespread panic. Moreover, it would cause significant economic losses. The sheer volume and sensitivity of financial data are immense. This, therefore, makes preparedness an existential imperative, not just a technical challenge.

An abstract image depicting a digital padlock surrounded by lines of code and currency symbols, with some lines appearing fragmented, symbolizing the vulnerability of financial systems to quantum threats.

The Quantum Clock is Ticking: Projections and Realities

The most powerful quantum computers are not here yet—that is, machines that can break current encryption. However, their development is accelerating rapidly. Consequently, experts and research institutions worldwide monitor “Q-Day.” This, specifically, is the point when CRQCs become powerful enough to undermine current standards.

Understanding Q-Day: When Vulnerability Becomes Reality

Projections for Q-Day vary; nevertheless, the consensus is clear. It’s not a distant problem for future generations; rather, it’s a threat that demands action. This action, indeed, is needed within the next decade.

| Source/Context | Projection for RSA/ECC Vulnerability | Key Details/Assumptions |

|---|---|---|

| Gartner (2029-2034) | RSA & ECC unsafe by 2029, broken by 2034 | This is a widely cited estimate. It highlights urgency. |

| Other Estimates | Early 2030s or 5-10 years | This is a general expert consensus. It often cites the rapid pace of quantum computing research. |

| Conservative Research | 15-20 years | This assumes more time. It is needed for powerful, error-corrected quantum machines. Still, it’s a critical timeframe. |

The differences in these timelines, therefore, underscore uncertainty. Predicting technological breakthroughs is inherently difficult. Nevertheless, the trend is undeniable; indeed, it pushes us toward a critical inflection point in cybersecurity.

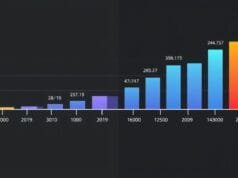

The Qubit Race: What It Takes to Break Encryption

A quantum computer’s power is often measured in qubits. For instance, in 2019, breaking a 2048-bit RSA encryption—a common standard—was estimated. It required approximately 20 million qubits. This figure, consequently, far outstrips today’s processors; for example, IBM’s 433-qubit Osprey (as of 2022) is a notable example.

Some claims have emerged; for instance, Chinese researchers suggested a hybrid approach in 2022. It could break RSA-2048 with just 372 qubits. However, these have not been credibly validated. Indeed, the broader scientific community has not confirmed them. As of early 2025, RSA-2048 remains unbroken, and no publicly credible quantum computer has achieved this. This “qubit gap,” therefore, provides a crucial window of opportunity. It is, however, shrinking.

Are Banks Ready? The Alarming Gap

Deadlines are looming. Warnings are clear. Yet, many financial institutions are dangerously unprepared, facing the quantum encryption threat. A recent F5 Labs report, for instance, painted a concerning picture. Only 2.9% of 145 analyzed banks supported Post-Quantum Cryptography (PQC) ciphers on their public websites. This statistic, therefore, highlights a significant readiness gap. Consequently, it suggests most banks operate with vulnerable encryption that could fall to future quantum attacks.

Transitioning to new cryptographic standards is complex. Indeed, it often requires fundamental architectural changes. Simple software patches, therefore, are not enough. This thus contributes to the lag. However, delaying action amplifies the risk. Moreover, it also increases the eventual cost of migration.

Building a Quantum-Resistant Future: The Path Forward

The global cybersecurity community is not waiting idly. Rather, a dedicated effort is underway. Specifically, new cryptographic algorithms are being developed and deployed, and they are designed to withstand quantum computers. This critical initiative, in short, is called Post-Quantum Cryptography (PQC).

Post-Quantum Cryptography (PQC): The New Foundation

PQC refers to cryptographic algorithms that are secure against classical computers. Furthermore, they also resist quantum computers. These new mathematical problems are believed to be intractable; indeed, this holds true even for future CRQCs. Developing these algorithms involves extensive research, requiring peer review and rigorous testing. This, consequently, ensures their robustness against all known attack vectors. It’s a race against time; however, progress is promising.

NIST’s Guiding Hand: Standardization Efforts

The U.S. National Institute of Standards and Technology (NIST) is at the forefront. Indeed, they lead a global effort to standardize PQC algorithms. This is a multi-year process that, furthermore, evaluates numerous proposed algorithms from researchers worldwide. As of August 2024, NIST released its first set of PQC standards. This consequently marked a pivotal moment in cybersecurity history:

- For instance, CRYSTALS-Kyber (now ML-KEM): Chosen for general encryption, it is crucial for establishing secure keys.

- Next, CRYSTALS-Dilithium (ML-DSA): Selected for digital signatures, this is vital for verifying identities. Moreover, it also authenticates data.

- Finally, SPHINCS+: This is another digital signature algorithm. It offers an alternative with different security properties.

NIST’s roadmap is clear. Specifically, they plan to deprecate classical cryptographic algorithms by 2030. Furthermore, they will fully phase them out by 2035. This consequently provides a tangible timeline. Therefore, organizations can plan their migration strategies. Learn more about their efforts by visiting [NIST’s PQC Project Page](https://csrc.nist.gov/projects/post-quantum-cryptography).

Strategies for Financial Resilience: Agility and Hybrid Approaches

For financial institutions, PQC transition is monumental. Indeed, it requires significant investment and coordination. However, several strategic approaches can nevertheless ease this migration.

- First, Crypto Agility: This means designing systems so they can quickly switch between cryptographic algorithms. Agile systems can adapt; that is, they are not locked into one standard. This happens as new threats emerge. Moreover, it also adapts when new PQC algorithms are standardized. This consequently minimizes disruption. Ultimately, it enhances long-term resilience.

- Next, Hybrid Approaches: This is a recommended interim solution. It combines traditional and post-quantum algorithms. A digital signature, for example, might use both RSA and CRYSTALS-Dilithium. This consequently ensures backward compatibility. Furthermore, it also provides a layer of quantum resistance. In essence, it offers a “belt-and-suspenders” security approach.

- Finally, Inventory and Assessment: The first step for any organization is crucial. Therefore, thoroughly inventory all cryptographic assets. Specifically, identify critical systems. Then, assess their vulnerability to quantum attacks. This ultimately forms the basis for a strategic migration roadmap.

Beyond PQC: The Promise of Quantum Key Distribution

PQC focuses on new algorithms that classical computers can run. However, another exciting area is Quantum Key Distribution (QKD). QKD leverages quantum physics’ fundamental laws. Specifically, it creates and exchanges encryption keys in a theoretically unbreakable manner. Any eavesdropper attempt to intercept the key fails; indeed, it instantly alters its quantum state. This consequently makes intrusion immediately detectable.

QKD is still in early development. Thus, it has practical limitations regarding distance and infrastructure. However, it offers a tantalizing glimpse, suggesting a future of truly unhackable key exchange. It represents a different paradigm from PQC; nevertheless, it contributes to the overall defense. Ultimately, it helps against a quantum encryption threat.

Your Role in a Quantum-Ready World

The shift to a quantum-resistant world is a collective responsibility. Indeed, it involves governments, industries, and individuals. For instance, governments and security agencies are mandating PQC adoption; specifically, the NSA and EU cyber agencies require it for critical infrastructures. This must happen within the next decade because they recognize profound national security implications. Similarly, leading financial institutions are investing in quantum computing research; for example, JPMorgan, HSBC, and Intesa Sanpaolo seek applications like fraud detection and risk modeling. They are also integrating PQC into their security roadmaps.

What You Can Do

Technical heavy lifting falls to institutions; however, your awareness and support are still vital.

- First, Stay Informed: Keep an eye on news. Specifically, look for reputable sources to understand quantum computing and cybersecurity. This, consequently, empowers you to make informed decisions.

- Next, Demand Transparency: Engage with financial services. Moreover, question your providers about their quantum readiness plans. Your voice, therefore, can drive change and accountability.

- Finally, Practice Good Digital Hygiene: PQC is being implemented. Therefore, continue to use strong, unique passwords. Furthermore, enable multi-factor authentication. Also, be wary of phishing attempts. These fundamental practices, indeed, remain critical, regardless of the cryptographic landscape.

The Collective Call to Action

Experts universally emphasize preparation. Indeed, the time for the quantum encryption threat is now. Uncertainties linger; for example, we don’t know the exact timeline for large-scale, error-corrected quantum computers. Still, the risks of inaction far outweigh the costs of early preparation. Therefore, proactive planning is crucial. Specifically, inventorying cryptographic assets is important. Moreover, conducting risk assessments and developing strategic migration roadmaps are vital first steps.

By working together, we can ensure our digital economy remains secure. Specifically, it will be resilient and quantum-ready. This consequently protects our financial stability and personal privacy. Ultimately, it safeguards them for generations to come. The future of our digital security, therefore, depends on choices made today.

What steps do you believe are most critical for governments and financial institutions to take right now to mitigate the impending quantum encryption threat?