Understanding NVIDIA’s GPU pricing strategy is crucial in today’s dynamic market. NVIDIA, a dominant force, shapes the industry through a complex approach. This involves inventory management, generational transitions, and intense competition. Furthermore, a seismic strategic pivot towards artificial intelligence also profoundly influences costs. The [GPU market has recently transformed](https://jompatech.com); for instance, prices swung from crypto booms to steep reductions. Now, [new hardware generations](https://jompatech.com/rtx-5000-super-vram-upgrade-50-boost-confirmed/) are emerging. NVIDIA is also [deepening its role in AI](https://jompatech.com/samsung-challenges-apple-the-ai-foldable-future-arrives/). Consequently, multifaceted drivers define GPU pricing. This article explores NVIDIA’s strategy. It examines the historical context, current market dynamics, and future trajectories of GeForce RTX cards.

The early 2020s, indeed, witnessed an extraordinary surge in GPU demand. Specifically, this was primarily attributable to the booming [cryptocurrency mining industry](https://www.britannica.com/money/what-is-crypto-mining-overview-benefits-risks). Digital currencies, most notably [Ethereum](https://ethereum.org/en/), heavily relied on powerful graphics cards for their mining operations. Consequently, there was an insatiable global need for these components, profoundly impacting [graphics card pricing dynamics](https://www.tomshardware.com/news/gpu-price-index). This, in turn, led to [severe supply shortages](https://en.wikipedia.org/wiki/2020%E2%80%932023_global_chip_shortage) and unprecedented price hikes, directly influencing NVIDIA graphics card prices. As a direct result, gamers and PC builders struggled immensely to acquire new GPUs at MSRP. Moreover, resellers and crypto miners quickly bought all available stock, profoundly distorting [the entire market](https://jompatech.com/kotlin-unleashing-modern-android-server-power/). Therefore, NVIDIA and its partners found it nearly impossible to meet the overwhelming demand during this period, putting immense pressure on NVIDIA GPU pricing strategy.

However, the [crypto market's inherent volatility](https://www.kraken.com/learn/what-is-volatility-in-crypto) eventually triggered a dramatic downturn. By late 2021 and early 2022, [cryptocurrency mining became far less profitable](https://www.pcmag.com/news/no-one-is-profitable-gpu-mining-faces-dark-days-after-ethereum-merge), causing a significant shift in GPU market analysis. This crash, indeed, immediately impacted the GPU market. Consequently, miners, no longer earning profits, began offloading their used graphics cards, which subsequently flooded the [secondary market](https://www.techspot.com/article/2944-best-used-graphics-cards/). Simultaneously, demand from new miners simply vanished. This sudden influx of used GPUs, coupled with rapidly dwindling demand, ultimately created a massive industry oversupply crisis, forcing a re-evaluation of NVIDIA GPU pricing strategy. As a result, retailers and manufacturers faced overflowing warehouses, and their inventory quickly lost considerable value.

Market Correction’s Impact on NVIDIA GPU Pricing Strategy

This substantial oversupply, therefore, directly led to [widespread price reductions across the industry](https://jompatech.com/rtx-5000-price-drops-whats-driving-gpu-cost-reductions/). By June 2022, the market correction was in full swing, offering much-needed relief to NVIDIA graphics card prices. For instance, popular cards like the [NVIDIA GeForce RTX 3080](https://jompatech.com/rtx-4080-vs-rtx-5080-the-ultimate-gpu-showdown/), which once sold for over $1,000, reportedly fetched around $650 on platforms such as eBay, indicating a major shift in GeForce price trends. Furthermore, [AMD's current-generation GPUs](https://www.amd.com/en/graphics/radeon-rx-graphics) also experienced significant price declines, often selling for roughly 92% of their MSRP. Crucially, this period initiated a necessary [market reset](https://www.techspot.com/news/2023-cpu-gpu-markets-cratered-end-2022.html). Manufacturers and retailers were compelled to clear surplus stock, and consequently, prices moved closer to historical norms, much to the relief of consumers. Indeed, the crypto crash fundamentally reshaped consumer expectations and moreover, set a clear precedent for future price adjustments, highlighting the [market's sensitivity to external economic factors](https://jompatech.com/explore-paypal-upcoming-policies-2024-update-2/) and impacting NVIDIA GPU pricing strategy.

Navigating New Generations: RTX 40 and 50 Series GeForce Price Trends

NVIDIA’s gaming GPU revenue initially took a hit following the cryptocurrency crash. However, a much larger [strategic transformation](https://jompatech.com/blackwell-architecture-performance-gains-a-deep-dive/) was already unfolding within the company, one that would profoundly influence NVIDIA GPU pricing strategy. Specifically, NVIDIA was rapidly pivoting its core focus to artificial intelligence. Given that NVIDIA had always been a leader in parallel computing, this technology was perfectly suited for the demanding computational needs of AI and machine learning. Therefore, this foresight ideally positioned them to capitalize on the burgeoning AI market, fundamentally reshaping their entire business model.

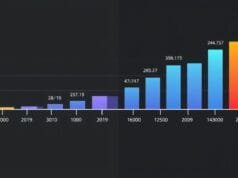

Notably, NVIDIA’s data center and AI GPU segment has, in fact, experienced explosive growth, a key factor in any GPU market analysis. To illustrate, the company shipped an estimated 3.76 million AI-focused units in 2023, with projections nearing 4 million for 2024. Consequently, NVIDIA now commands a dominant 98% market share in the rapidly expanding data center GPU market.

Indeed, the financial impact of this strategic shift is staggering. For example, NVIDIA’s data center division generated over $10.3 billion in revenue by Q2 FY2024, marking a monumental 171% year-over-year increase. Furthermore, this revenue significantly overshadowed the gaming division’s $2.5 billion in the same period. By early 2025, the data center segment accounted for an astonishing 91% of NVIDIA’s total sales, representing a dramatic jump from 60% in 2023, further influencing NVIDIA pricing factors.

The Delicate Balance of Graphics Card Pricing Dynamics for NVIDIA in NVIDIA GPU Pricing Strategy in NVIDIA’s Graphics Card Prices and GeForce Price Trends in NVIDIA’s Pricing Strategy

Evidently, this profound change in revenue composition clearly signals a reordering of NVIDIA’s corporate priorities. Due to the immense profitability and strategic importance of AI accelerators, gaming GPUs are now less central to the company’s financial well-being, directly impacting the overall NVIDIA GPU pricing strategy. Nevertheless, they remain vital to the brand’s identity; they are, however, less critical to the company’s financial health and future trajectory.

Therefore, this strategic pivot directly influences NVIDIA's GPU pricing strategy for consumer-grade graphics cards. With reduced pressure to extract maximum gaming profit, NVIDIA might adopt more flexible pricing, and indeed, it could even be aggressive in specific segments. For instance, this approach could help maintain market share, clear inventory, or strategically prepare for next-generation products. Consequently, the company can afford to experiment with pricing, or alternatively, it can heavily focus its cutting-edge innovation on AI rather than exclusively on raw gaming performance, changing [GeForce price trends](https://jompatech.com/).

Future Outlook for NVIDIA GPU Pricing Strategy

The cyclical nature of technology inherently dictates constant new product generations, and the GPU market is certainly no exception. NVIDIA’s strategy around its GeForce RTX series GPUs, specifically their launch and lifecycle, significantly impacts [RTX 40 and 50 Series GeForce Price Trends](https://jompatech.com/nvidia-rtx-50-series-release-ces-2025-unveiling-specs/) across the board. Indeed, each new generation introduces advancements in architecture, performance, and features. Consequently, this invariably leads to necessary price adjustments for preceding models, directly affecting NVIDIA GPU pricing strategy. The RTX 40 series and the anticipated RTX 50 series provide compelling current and future examples of this dynamic.

Anticipated RTX 50 Series NVIDIA GPU Pricing Strategy (2025 and Beyond)

Following its initial launch, the NVIDIA GeForce RTX 40 series experienced significant price reductions throughout 2024, an indicator of evolving NVIDIA GPU pricing strategy. These cards, from the RTX 4060 to the RTX 4080 Super, saw widespread deals in regions like the UK, making powerful GPUs more accessible to consumers.

For instance, an MSI RTX 4070 12GB Ventus 2X E1 OC dropped from £539.99 to £479.99. A Gigabyte RTX 4070 12GB EAGLE OC V2 fell from £519.98 to £399.99 – a substantial 23% markdown. Even the RTX 4070 Super saw price adjustments, with a Gainward model dropping from £668.99 to £518.99, demonstrating the active GeForce price trends.

These price cuts, significantly, were not random occurrences. Instead, they primarily reflected NVIDIA pricing factors and strategic objectives. Firstly, clearing existing RTX 40 series inventory was essential, maintaining healthy stock levels and avoiding oversupply. Secondly, these reductions served as a calculated move to prepare the market for the eventual transition to next-generation RTX 50 series GPUs, making current offerings more attractive before new models arrived.

Future Outlook for NVIDIA GPU Pricing Strategy in Graphics Card Pricing Dynamics

Looking ahead, the anticipated launch of the NVIDIA GeForce RTX 50 series, codenamed “Blackwell,” is expected to bring further shifts in NVIDIA GPU pricing strategy. Early reports and rumors in mid-2025 suggested aggressive price cuts shortly after launch, particularly due to initial low sales volumes and potential oversupply issues. To illustrate, some RTX 5070 models reportedly hit their $549 MSRP, while the flagship RTX 5090 neared its $1,999 MSRP, influencing overall graphics card pricing dynamics.

Nevertheless, achieving these suggested retail prices presents considerable obstacles, especially for NVIDIA’s board partners (AIBs). They face increasing pressure on profit margins due to higher component costs, most notably for next-generation GDDR7 memory. While GDDR7 boosts performance, its premium price point, combined with NVIDIA’s tight margins, challenges AIBs to release custom RTX 50 series cards at or below MSRP. Consumers might thus see custom models priced significantly above MSRP, as mid-2025 reports showed GeForce RTX 5090 models nearly 30% above Founders Edition MSRP, highlighting evolving graphics card pricing dynamics. This tension between NVIDIA’s strategic pricing and AIBs’ operational costs remains a core NVIDIA pricing factor.

Future Outlook for NVIDIA GPU Pricing Strategy

While NVIDIA commands a significant share of the discrete GPU market, it certainly does not operate in a vacuum. This is especially true at the high end. Competition from rivals like AMD, and newer entrant Intel, plays a crucial role. Indeed, it significantly shapes NVIDIA GPU pricing strategy. Moreover, consumer sentiment, having been profoundly impacted by past market volatility, also exerts considerable influence on NVIDIA graphics card prices.

Key NVIDIA Pricing Factors Driving GPU Decisions

Advanced Micro Devices (AMD) remains NVIDIA’s primary competitor in the gaming GPU space. Consequently, AMD often positions its Radeon graphics cards as offering a strong value proposition, particularly in the mid-range segment, which in turn influences NVIDIA GPU pricing strategy. Historically, they have emphasized features like higher VRAM capacities at competitive price points. This, in turn, can pressure NVIDIA to match or exceed these offerings. Therefore, when AMD launches a new series with compelling performance-per-dollar ratios, NVIDIA may respond with price adjustments or alternatively, offer strategically timed “Super” variants of existing cards to maintain its competitive edge, impacting GeForce price trends. Ultimately, this ongoing rivalry actively benefits consumers by fostering innovation and encouraging more aggressive pricing.

In addition, Intel, traditionally known for integrated graphics, has successfully entered the discrete GPU market with its Arc series. Presently, Intel’s current offerings tend to target the budget and mid-range segments. Nevertheless, their presence adds another crucial layer of competition. Furthermore, as Intel refines its GPU technology, it could exert further downward pressure on entry-level and mainstream NVIDIA graphics card prices, forcing both NVIDIA and AMD to continuously re-evaluate their value propositions. Ultimately, these viable alternatives ensure NVIDIA cannot set prices entirely unilaterally, as market forces and competitive offerings must always be considered in any GPU market analysis.

1. Oversupply, Inventory, and NVIDIA GPU Pricing Strategy

Consumer sentiment has, indeed, been significantly shaped by recent tumultuous events in the market. The era of inflated prices during the crypto mining boom left many buyers feeling alienated and frustrated. Subsequently, this period was followed by dramatic price drops, which created a strong anticipation among consumers for further reductions. Consequently, many buyers now exhibit a “wait and see” approach, expecting prices to fall over time, or they wait for “Super” variants or next-generation cards, profoundly influencing NVIDIA GPU pricing strategy. For this reason, even if a new GPU is technically worth its MSRP, a segment of the market will hesitate, believing a better deal is just around the corner.

Therefore, this collective consumer expectation can significantly influence sales volumes and, in turn, it directly affects NVIDIA GPU pricing strategy. If initial sales for a new product generation are slower, NVIDIA and its partners may be compelled to introduce price cuts to stimulate demand and move inventory. This dynamic creates a delicate balance for manufacturers: they must price new products aggressively to attract early adopters while simultaneously managing long-term inventory and satisfying price-conscious consumers. Ultimately, the post-crypto market has fundamentally altered the relationship between supply, demand, and consumer perception of value, impacting graphics card pricing dynamics.

2. New Product Generations, Tech Advancements, and GeForce Price Trends

NVIDIA’s graphics cards are not solely manufactured by NVIDIA itself. Instead, a vast network of “board partners,” or Add-in Board (AIB) manufacturers, plays a critical role. Companies like ASUS, MSI, Gigabyte, and ZOTAC design and produce unique versions of GeForce GPUs, incorporating their own cooling systems, power delivery, and aesthetics. These partners are crucial for market distribution and product variety. However, they often face significant challenges with profit margins, and thus, this directly influences the final street price of NVIDIA GPUs, impacting NVIDIA graphics card prices.

Board partners acquire GPU chips (dies) from NVIDIA and source other vital components like memory and PCBs. Component costs, especially for high-performance GDDR memory, significantly impact manufacturing expenses and are critical NVIDIA pricing factors. For instance, the RTX 50 series’ GDDR7 memory boosts performance but increases cost. These higher material expenses often squeeze AIB profit margins, making it difficult to price custom cards at NVIDIA’s baseline MSRP. AIBs also invest in R&D for custom cooling, RGB, and software, plus marketing and warranty costs. This makes NVIDIA GPU pricing strategy a complex dance between NVIDIA’s MSRP guidelines and partner realities.

3. Market Diversification, AI Demand, and GPU Market Analysis

Nevertheless, custom AIB cards inherently carry additional production costs due to their advanced cooling systems and factory-overclocked performance. If NVIDIA’s suggested MSRP leaves little room for these extra expenditures, AIBs must sell their custom models above MSRP to maintain profitability. This dynamic was clearly evident with the RTX 50 series, where early reports showed custom cards significantly exceeded the Founders Edition MSRP. Consequently, the relationship between NVIDIA and its board partners represents a delicate balance that directly impacts graphics card pricing dynamics.

NVIDIA relies heavily on its partners for market reach and product diversity. Yet, it also pursues its own financial targets and strategic priorities, such as its pivot toward AI. Meanwhile, AIBs must ensure their businesses remain viable, facing fluctuating component costs, competitive pressures, and NVIDIA’s evolving pricing structures. This inherent tension, in turn, creates a complex pricing landscape for consumers, further complicated by GPU market analysis of AI demand. Thus, the same GPU chip can have varying prices depending on the AIB, its cooling solution, and factory overclock settings.

Ultimately, the margin squeeze on board partners makes it challenging to achieve NVIDIA’s ambitious MSRPs for high-performance cards, thereby impacting real-world availability and cost for end-users and reshaping NVIDIA GPU pricing strategy.

4. Competitive Pressures as NVIDIA Pricing Factors

NVIDIA’s GPU pricing strategy is not a monolithic entity. Instead, it represents a dynamic response to various internal and external forces. Indeed, several key NVIDIA pricing factors consistently drive the company’s decisions relating to the cost of its graphics cards.

5. Component Costs, Manufacturing, and Graphics Card Pricing Dynamics

A primary driver for price adjustments, particularly reductions, is the necessity of clearing excess inventory. This applies whether it’s after a market boom, like crypto mining, or before a new product launch. Manufacturers and retailers need to move unsold stock, as holding large quantities of older-generation GPUs ties up capital, occupies valuable warehouse space, and risks rapid depreciation as newer, more powerful cards emerge. Consequently, strategic price cuts are a direct tool to manage inventory efficiently, thus ensuring market liquidity and preventing financial stagnation, profoundly affecting NVIDIA GPU pricing strategy.

Future Outlook for NVIDIA GPU Pricing Strategy

The relentless pace of technological innovation is a constant force. Specifically, the impending release of next-generation GPUs, such as the RTX 50 series replacing RTX 40 series, invariably prompts price reductions for older models, a core part of NVIDIA GPU pricing strategy. This strategy serves a dual purpose: it makes older cards more appealing to budget-conscious consumers, allowing inventory clearance, and in addition, it simultaneously highlights the new generation’s value proposition. Thus, this cyclical refresh mechanism is fundamental to the tech industry and remains a cornerstone of NVIDIA's pricing calendar.

Product Cycles, Competition, and NVIDIA GPU Pricing Strategy

Undoubtedly, the most significant recent shift is NVIDIA’s dramatic reorientation toward the data center and AI sectors. The explosive growth and immense profitability of AI accelerators have elevated them to NVIDIA’s top priority. Consequently, this strategic diversification means gaming GPUs are now less critical to the company’s overall financial performance; while still important, they carry less weight. Therefore, this shift allows NVIDIA more flexibility in gaming GPU pricing. They can be more aggressive with gaming card prices to maintain market share or clear stock, since their primary revenue growth now stems from AI. In addition, cutting-edge innovation and premium pricing are increasingly reserved for AI-focused hardware.

The presence of strong competitors like AMD, and increasingly Intel, acts as a crucial check on NVIDIA GPU pricing strategy. Specifically, AMD focuses on competitive performance, VRAM offerings, and value in certain segments, particularly in the mid-range. For instance, this compels NVIDIA to price its cards strategically to remain attractive. If a competitor offers a compelling alternative at a lower price, NVIDIA may introduce price drops or bundle deals, or alternatively, it might introduce “Super” variants to maintain its market position. Consequently, the consumer ultimately benefits from this robust competition.

5. Component Costs and Manufacturing Efficiencies

The cost of raw materials and components directly impacts a GPU’s overall manufacturing cost, including GDDR memory, silicon wafers, and power delivery components. Specifically, as new generations adopt more advanced, often more expensive memory technologies like GDDR7, the base cost inevitably increases. Furthermore, manufacturing efficiencies, production scale, and yield rates also play a significant role. These costs are then passed down, influencing the MSRP and board partners’ ability to offer competitive prices. In effect, the margin squeeze on AIBs, driven by escalating component costs, directly translates into higher street prices for custom cards and impacts NVIDIA graphics card prices.

These factors intertwine, creating a complex web that NVIDIA must navigate with each product launch and market adjustment. Indeed, the company’s ability to balance these elements ultimately defines its long-term success and also shapes the consumer experience in the GPU market, reflecting dynamic graphics card pricing dynamics.

Future Outlook for GPU Pricing

GPU pricing, especially for NVIDIA’s GeForce series, will remain highly dynamic, shaped by powerful forces. NVIDIA’s increasing AI focus means gaming GPUs might see more aggressive pricing to encourage adoption or less emphasis on gaming-specific innovation, impacting NVIDIA GPU pricing strategy. Consumers could find exceptional value, particularly during product transitions. New generations, like the upcoming RTX 50 series, will invariably prompt price reductions for older models, allowing savvy buyers to secure discounts on current-gen cards. However, initial custom RTX 50 series prices may be elevated due to board partner margins and GDDR7 costs, although market competition will likely lead to adjustments.

Competition from AMD and Intel remains critical, constantly influencing NVIDIA GPU pricing strategy. AMD’s competitive performance and VRAM offerings, particularly in the mid-range, pressure NVIDIA. Intel’s growing presence could further intensify this, benefiting consumers through innovation and driving more friendly NVIDIA graphics card prices. Ultimately, the future GPU market offers opportunities. While cutting-edge tech commands a premium, AI’s influence and inventory management will evolve NVIDIA's GPU pricing, making a more rational and predictable landscape emerge despite ongoing shifts.

Frequently Asked Questions

Q1: Why did GPU prices drop significantly after 2022?

GPU prices dropped significantly after 2022 primarily due to the collapse of the cryptocurrency mining boom. Specifically, the decline in crypto profitability led miners to sell off vast quantities of used GPUs, which subsequently flooded the market with supply. Simultaneously, demand from new miners simply evaporated. Consequently, this created a massive oversupply, forcing manufacturers and retailers to reduce prices, profoundly influencing [graphics card pricing dynamics](https://www.tomshardware.com/news/gpu-price-index) and the overall GPU market analysis.

Q2: How does NVIDIA’s focus on AI affect gaming GPU prices?

NVIDIA’s increasing focus on AI has made its data center and AI GPU segment incredibly profitable and, moreover, strategically important. This shift means gaming GPUs are now less critical to the company’s overall revenue. Consequently, NVIDIA may adopt more flexible or aggressive NVIDIA GPU pricing strategy for gaming cards to offer discounts, maintain market share, or clear inventory. After all, its primary financial growth currently comes from AI accelerators.

Q3: Are RTX 40 series GPUs still seeing price drops?

Yes, in 2024, NVIDIA’s GeForce RTX 40 series GPUs experienced widespread price drops from retailers, including models from the RTX 4060 to the RTX 4080 Super. These reductions were driven by two main factors. Firstly, clearing existing inventory was essential. Secondly, preparing the market for the upcoming RTX 50 series was key. As a result, these changes made them more accessible to consumers and reflected a responsive NVIDIA GPU pricing strategy.

Q4: Why are custom RTX 50 series cards sometimes more expensive than NVIDIA’s MSRP?

Custom RTX 50 series cards from board partners (like ASUS, MSI) can be more expensive than NVIDIA’s suggested MSRP due to several factors. Board partners incur additional costs for designing advanced cooling solutions, custom PCBs, and integrating more expensive components. For example, next-gen GDDR7 memory adds to this expense. These increased manufacturing costs, combined with the need for a profit margin, often lead to custom cards being priced above NVIDIA’s baseline MSRP, a key aspect of [graphics card pricing dynamics](https://www.tomshardware.com/news/gpu-price-index).

Q5: Will GPU prices continue to fall in the future?

GPU prices are likely to remain dynamic, with continued fluctuations. However, a dramatic collapse, like the post-crypto era, is less probable. Instead, strategic price adjustments will persist. Anticipate further price reductions for older-generation cards as new ones launch. Moreover, watch for competitive pressures from AMD and Intel to drive value. NVIDIA’s AI pivot also suggests a potential for more aggressive gaming GPU pricing to help maintain market share. Indeed, a more rational and predictable pricing landscape is emerging, despite ongoing strategic shifts, reflecting evolving NVIDIA GPU pricing strategy.