In today’s fiercely competitive global marketplace, implementing effective manufacturer price reduction strategies is vital for survival. Manufacturers therefore require agility and strategic foresight in pricing. Price adjustments are not just mathematical; instead, they drive market positioning and profitability. Static, cost-plus pricing is fading rapidly. Dynamic, data-driven approaches now respond to market shifts and evolving customer expectations. This guide explores adjusting pricing to thrive. Manufacturers navigate complex internal costs and customer demand. Furthermore, strategic reductions unlock competitive advantages. Companies can penetrate new markets, manage inventory, and bolster their bottom line. Ultimately, understanding these strategies is fundamental to modern success.

The Evolving Landscape of Manufacturer Price Reduction Strategies

Historically, manufacturing pricing frequently relied on simple cost-plus models. Specifically, this entailed calculating production costs and then adding a fixed markup. However, this straightforward approach often failed to consider crucial market realities, including, for example, customer perceived value, competitive pressures, and fluctuating demand. Currently, therefore, the digital age has ushered in a new era for manufacturer price reduction strategies. Manufacturers now, furthermore, possess vast data and advanced analytical tools. Consequently, these resources empower them to make proactive, intelligent industrial pricing adjustments, moving beyond merely reacting to market shifts.

This shift is, indeed, significant. Global supply chains, rapid technological advancements, and unpredictable economic conditions all, therefore, necessitate more nuanced manufacturer price reduction strategies. For example, businesses such as General Electric (GE), within its industrial segments, and equally, Siemens, regarding its automation offerings, must continually reassess their value. Moreover, they are required to adjust their enterprise pricing models. These models, consequently, need to accurately reflect innovation, service differentiation, and prevailing market dynamics. This evolution effectively transforms pricing from a mere back-office function into a core strategic competency, impacting, therefore, every business facet, ranging from product development to sales and marketing.

Core Manufacturer Price Reduction Strategies

Price reduction, when implemented strategically, should not be interpreted as a sign of weakness. Rather, it functions as a powerful tool, designed to help achieve specific business objectives. Manufacturers, consequently, employ diverse manufacturer price reduction strategies. Indeed, each strategy is specifically suited to different market conditions, product lifecycles, and competitive landscapes. Therefore, a thorough understanding of these distinct factory pricing tactics is absolutely crucial for crafting an effective pricing roadmap.

Competitive Pricing: A Driver for Manufacturer Price Reduction Strategies

Dynamic pricing, firstly, marks a significant shift from traditional static models. It entails adjusting prices in real-time, often occurring multiple times daily. Prices, consequently, fluctuate based on numerous factors, including customer demand, competitor pricing, inventory levels, and even time or location. This is a core element of modern manufacturer price reduction strategies, aiming for continuous revenue and profitability optimization.

This strategy leverages advanced data analytics, AI, and machine learning to analyze vast datasets, identifying patterns and predicting market behavior. An industrial manufacturer uses these insights for industrial pricing adjustments, increasing prices during demand spikes or reducing them in slower periods for inventory management. Companies like Amazon use dynamic pricing effectively. However, B2B often requires sophisticated CPQ solutions from vendors like SAP or Salesforce, automating complex supply chain pricing methods.

The benefits extend beyond revenue maximization. Dynamic pricing significantly aids inventory management, preventing costly stockouts or overstock. Additionally, it offers a distinct competitive advantage, as manufacturers can instantly react to rivals’ prices and capitalize on market inefficiencies. Therefore, nimbleness and responsiveness define these crucial manufacturer price reduction strategies.

Tiered and Flexible Pricing: An Enterprise Pricing Model for Manufacturer Price Reduction Strategies

Unlike cost-plus pricing, which focuses inward on production expenses, value-based pricing primarily looks outward at the customer. This strategy sets prices based on a product or service’s perceived value, rather than the manufacturer’s costs. This approach, a key enterprise pricing model, demands a deep understanding of customer needs, pain points, and quantifiable economic benefits a solution provides.

Implementing value-based pricing, however, requires thorough market research and meticulous customer segmentation. Manufacturers must identify problems their products solve and the value customers place on those solutions. For instance, an industrial machinery manufacturer might price a new machine based on its boost to a customer’s production efficiency, reduced downtime, or labor cost savings. Thus, perceived long-term value, including after-sales service and reliability, becomes the core of these factory pricing tactics.

Initially, value-based pricing can be more complex. However, it often leads to significantly higher profit margins, ensuring manufacturers capture greater economic value. This approach prevents underpricing innovative solutions, a common pitfall with traditional models. Strategic consulting firms advise clients to unlock full potential by focusing on customer outcomes through advanced manufacturer price reduction strategies.

Adapting to Economic Adjustments with Strategic Manufacturer Price Reduction Strategies’s Role in Production Cost Cutting through Manufacturer Price Reduction Strategies

Competitive pricing involves setting prices primarily based on competitors’ offerings. This strategy is common in saturated markets, especially where products are largely undifferentiated. The goal, therefore, is to maintain or gain market share, achieved specifically by ensuring attractive prices against rivals using effective factory pricing tactics.

Manufacturers employing this strategy must, therefore, closely monitor competitors’ pricing. This often means quick reactions to rivals’ price drops, which in turn help prevent customer churn. It can, furthermore, involve matching or even undercutting competitor prices, particularly for specific products or market segments. For instance, in consumer electronics, TV or appliance makers frequently use these industrial pricing adjustments, primarily aiming to capture seasonal sales.

The effectiveness of competitive pricing depends heavily on accurate and timely competitive intelligence. This strategy is crucial for maintaining market position within manufacturer price reduction strategies. Nevertheless, it carries inherent risks: over-reliance can trigger destructive price wars, which ultimately erode industry-wide profitability. Therefore, it must be used carefully, often with other strategies, and also requires a clear understanding of one’s own cost structure.

Strategic Drivers: Understanding Manufacturer Price Reduction Strategies

Cost-plus pricing has, historically, been a manufacturing cornerstone. It involves adding a fixed percentage or amount (the markup) to the total production cost per unit, which subsequently determines the selling price. This method, consequently, offers simplicity and also guarantees that production costs are covered, thus ensuring a baseline profit. It remains a straightforward way to calculate prices, especially for custom orders or specialized industrial components where market comparisons are difficult, though less common in modern manufacturer price reduction strategies.

However, in today’s dynamic markets, relying solely on cost-plus pricing can be limiting. It often overlooks external factors, such as, for example, market demand, customer perceived value, and competitor pricing strategies. While it ensures cost coverage, prices may, at times, be too high to compete. Conversely, they might be too low to capture the full market value. Modern manufacturers, therefore, often use cost-plus as a starting point; subsequently, they adjust prices based on market intelligence and strategic objectives, reflecting advanced enterprise pricing models. This blended approach positions it as a foundation, but not the sole pricing determinant.

Leveraging Cost Reductions in Manufacturer Price Reduction Strategies as a Goal of Manufacturer Price Reduction Strategies

Penetration pricing is a strategy often employed when launching a new product, particularly in a competitive market. It involves setting an initially low price. The primary goal, therefore, is to quickly attract a large customer base and also rapidly gain market share. The objective, furthermore, is to make the product highly accessible, thereby appealing to price-sensitive customers and creating immediate market traction, a key manufacturer price reduction strategy.

This strategy, consequently, aims to overcome initial market resistance and also swiftly build brand awareness. Once, however, a significant market share is established, brand loyalty typically begins to form. Manufacturers may then gradually increase prices. A common example is found in the consumer tech sector. Manufacturers of commodity goods or new industrial materials also utilize this approach, often seeking to disrupt existing market structures. The success of penetration pricing, ultimately, relies on efficient production cost cutting and the ability to eventually reduce costs as volume increases.

Navigating the Impact: Consequences of Manufacturer Price Reduction Strategies through Effective Manufacturer Price Reduction Strategies

Price skimming, markedly, differs greatly from penetration pricing. This strategy, instead, involves launching a new product at a high price, specifically targeting early adopters and customers less sensitive to price. These customers are, by nature, eager for the latest innovations. The high initial price, consequently, helps recoup research and development (R&D) costs quickly and also signals premium quality, forming part of diverse enterprise pricing models.

Subsequently, after the initial market segment is saturated, prices are lowered. This action also occurs when competitors introduce similar products. This, in turn, allows the manufacturer to access subsequent market segments, which typically have greater price sensitivity. Apple’s iPhone launches, for example, are classic instances of price skimming: new models command premium prices upon release, whereas older models see industrial pricing adjustments over time. This approach, therefore, works best for products with unique features, strong brand recognition, or limited initial supply.

Responding to Competition with Manufacturer Price Reduction Strategies

Modern manufacturing in complex B2B sectors offers diverse products and services. Tiered pricing addresses this by providing different versions or levels, each with varying price points. Each tier includes distinct features, performance, or support services, representing a strategic enterprise pricing model within manufacturer price reduction strategies.

For instance, a software manufacturer might offer basic, standard, and premium versions of its industrial automation software, each with increasing capabilities and a corresponding price. This structure allows customers to choose a solution that best fits their specific requirements and budget. Tiered pricing maximizes revenue potential, appealing to multiple customer segments, contributing to effective wholesale price optimization.

Beyond static tiers, manufacturers also implement flexible pricing plans, including, for example, subscriptions, leasing, or pay-per-use models. Companies like Caterpillar offer various purchase and leasing options for heavy machinery, providing financial flexibility to clients. This adaptability is crucial in large capital expenditure industries, making products more accessible and attractive through these advanced factory pricing tactics.

Market Share and Sales Volume Gains from Manufacturer Price Reduction Strategies Dictating Manufacturer Price Reduction Strategies

Price reductions are, in fact, rarely random. Instead, they are typically executed for clear strategic reasons, specifically aiming to achieve specific business objectives. Understanding these underlying drivers, consequently, helps to explain a manufacturer’s decisions regarding their manufacturer price reduction strategies.

Robust Cost Reduction Initiatives: Essential Manufacturer Price Reduction Strategies

A primary reason for lowering prices is to gain a foothold in a new market and also rapidly increase market share for a new product. By offering, therefore, a more attractive price, manufacturers can entice price-sensitive customers, drawing them away from established competitors. This also encourages trial for innovative offerings. This strategy is particularly effective when entering highly competitive environments or introducing disruptive technologies, forming a key aspect of wholesale price optimization within manufacturer price reduction strategies. The goal, ultimately, is to establish presence and volume quickly, leveraging economies of scale.

Enabling Success: Key Factors for Effective Manufacturer Price Reduction Strategies

Excess inventory can significantly drain a manufacturer’s resources. It incurs storage costs, and furthermore, increases the risk of obsolescence, thereby tying up capital. Price reductions are, consequently, a common and effective manufacturer price reduction strategy. They help clear out stock of older models, seasonal products, or items with limited shelf life, which in turn minimizes losses and frees up warehouse space. This also allows for the introduction of new product lines. For instance, the automotive industry often offers incentives to clear out previous year models before new ones arrive, representing vital factory pricing tactics.

Profitability: Balancing Manufacturer Price Reduction Strategies

In dynamic markets, competitors’ pricing actions directly impact a manufacturer’s position. Aggressive pricing from rivals, therefore, often demands a strategic response, which includes price reductions. Such actions help maintain market share and also prevent customer defections. This is, in essence, a defensive strategy, aimed at protecting existing revenue streams and customer relationships, reflecting well-planned industrial pricing adjustments. However, manufacturers must be cautious: they should avoid triggering unsustainable price wars that harm all industry players.

Robust Cost Reduction Initiatives: A Pillar of Manufacturer Price Reduction Strategies

Broader economic conditions significantly influence spending for both consumers and businesses. During economic downturns, recessions, or periods of decreased confidence, manufacturers may, consequently, reduce prices to stimulate demand. Lowering prices can, furthermore, make products more accessible and appealing to a financially constrained customer base. This, in turn, helps maintain sales volume during challenging periods. This adjustment, ultimately, demonstrates an understanding of macroeconomic pressures and also reflects their direct impact on purchasing power, forming crucial manufacturer price reduction strategies.

Brand Perception: The Value Equation in Manufacturer Price Reduction Strategies

When production costs fall, manufacturers gain a valuable opportunity: they can pass these savings to customers through reduced prices. This reduction can stem from various factors, including, for example, lower raw material prices, improved manufacturing efficiency, automation, or optimized supply chains. By reducing prices, therefore, in line with cost savings, manufacturers can increase their competitive edge and also attract more customers. This, consequently, potentially boosts overall sales volume while maintaining healthy profit margins, making production cost cutting a vital part of manufacturer price reduction strategies. Therefore, this strategy clearly demonstrates a commitment to efficiency and value for the customer.

Achieving Competitive Advantage through Manufacturer Price Reduction Strategies

Price reductions, while serving critical strategic purposes, are nevertheless not without consequences. Manufacturers must, therefore, carefully weigh potential benefits against inherent risks. Pricing decisions, after all, have far-reaching effects, significantly impacting profitability, market perception, and competitive dynamics. Effective manufacturer price reduction strategies require meticulous planning to achieve competitive advantage.

Enabling Success: Key Factors for Effective Manufacturer Price Management

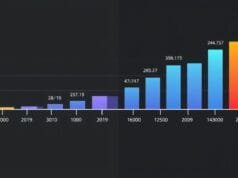

The most immediate impact of a price reduction is on profitability. While lower prices can indeed boost sales volume, this does not always translate into higher profits. Research, for instance, consistently highlights a crucial insight: price is often the strongest driver of profitability for manufacturers. A mere 5% price increase, for example, can lead to a remarkable 33% increase in operating income. In contrast, a 5% volume increase might only yield a 20% increase. This statistic, frequently cited by firms like McKinsey & Company in their pricing strategy analyses, powerfully underscores the leverage of optimal wholesale price optimization.

Unplanned or deep price cuts can, furthermore, quickly erode profit margins, even in the presence of an uptick in sales volume. Manufacturers must, therefore, conduct thorough break-even analyses and also understand the elasticity of demand for their products. This, consequently, ensures any manufacturer price reduction strategy is sustainable and contributes positively to the bottom line, rather than merely boosting top-line revenue at the expense of profit. Ultimately, therefore, the optimal price is not always the one that sells the most units; instead, it is the one that maximizes overall profit.

Market Share and Sales Volume: The Volume Play

One primary goal of price reduction is to increase market share and also drive sales volume. By making products, therefore, more affordable, manufacturers can attract new customers and also capture segments previously out of reach due to price. Furthermore, this encourages existing customers to buy more often or in larger quantities. In competitive markets, consequently, even a slight price advantage can translate into significant gains, especially for products where price is a dominant factor in purchasing decisions, aligning with strategic manufacturer price reduction strategies.

However, this approach’s effectiveness depends heavily on market elasticity. Specifically, if demand is inelastic (meaning customers are not very sensitive to price changes), a price reduction may not lead to a significant sales volume increase, thereby resulting in pure margin erosion. Conversely, in highly elastic markets, a strategic price cut can unlock substantial sales growth, proving the value of refined factory pricing tactics.

Brand Perception: The Value Equation

Price clearly influences consumer perception regarding both brand and product quality. For value-oriented brands or commodity products, a lower price can, in fact, be seen as a bargain, thus enhancing attractiveness. However, for premium or luxury brands, significant price cuts can be damaging. They might, consequently, raise questions about quality, exclusivity, or the brand’s intrinsic value, potentially cheapening its image. For example, a luxury car manufacturer must exercise extreme caution with discounts to avoid diluting brand equity when implementing manufacturer price reduction strategies.

Manufacturers must, therefore, carefully manage brand perception, especially when implementing price reductions. This often involves framing the reduction as a “special offer” or “promotional discount,” or perhaps even a “limited-time sale.” It should, crucially, not be presented as a permanent price adjustment. Consequently, the context and communication surrounding a price change are as vital as the change itself within any supply chain pricing method or enterprise pricing model.

Competitive Advantage and Price Wars: The Battlefield

Strategic price reductions can, indeed, provide a competitive edge. This is especially true if a manufacturer can sustain lower prices, a capability often stemming from superior cost structures or greater efficiency. Such manufacturer price reduction strategies can, furthermore, pressure competitors who cannot match the reduction, potentially forcing them to lose market share or operate at lower profit margins.

However, price reductions also risk triggering a price war. When, therefore, competitors retaliate with their own price cuts, an escalating cycle can begin, which consequently drives down average market prices for everyone. This often leads to a “race to the bottom,” where all players suffer from reduced profitability. Therefore, manufacturers must thoroughly analyze their competitive landscape and also anticipate reactions before starting aggressive industrial pricing adjustments. Sometimes, in fact, it is better to differentiate on value or service, thus avoiding a costly pricing battle.

Enabling Success: Key Factors for Effective Price Management

Moving towards more agile and intelligent pricing strategies, consequently, requires manufacturers to build specific capabilities and embrace certain operational philosophies. These factors are crucial for implementing manufacturer price reduction strategies both effectively and sustainably.

Robust Cost Reduction Initiatives

The ability to strategically reduce prices without losing profitability depends heavily on a manufacturer’s cost structure. Therefore, robust cost reduction initiatives are absolutely critical for effective production cost cutting. Strategies like lean manufacturing, pioneered by companies such as Toyota, for example, aim to eliminate waste across the entire production process. Optimizing supply chains, negotiating better terms with suppliers, and also investing in automation can furthermore significantly lower costs.

When, therefore, manufacturers produce goods more efficiently and at a lower cost, they gain greater pricing flexibility. They can, consequently, widen profit margins at existing price points. Alternatively, however, they can pass these savings to customers through price reductions. This, in turn, gives them a competitive advantage. Thus, identifying and eliminating non-value-adding costs is vital, as it directly empowers strategic manufacturer price reduction strategies.

Advanced Data Analytics and Technology

In the era of dynamic and value-based pricing, data is, indeed, paramount. Advanced analytics, AI, and machine learning are, consequently, no longer optional but vital necessities. These technologies provide manufacturers with deep insights, revealing, for example, market trends, customer behavior, competitive actions, and internal cost drivers. They enable predictive modeling, which in turn allows manufacturers to anticipate demand fluctuations and then optimize industrial pricing adjustments effectively.

Furthermore, specialized technology solutions like Configure, Price, Quote (CPQ) platforms are becoming indispensable, especially for manufacturers of complex, customizable products. CPQ solutions automate and streamline the entire pricing process, thereby ensuring accuracy, consistency, and the rapid generation of optimal quotes. This technological backbone, moreover, allows for the swift implementation and continuous adjustment of sophisticated enterprise pricing models. Major technology providers such as Oracle and Microsoft Dynamics, for instance, offer comprehensive ERP and CRM suites that integrate pricing functionalities.

Proactive Market Agility

In today’s volatile global economy, manufacturers must, above all, be agile. They need to react swiftly to external factors, including, for example, geopolitical shifts, trade tariffs, and supply chain disruptions. Sudden changes in raw material costs also matter significantly. Proactively adjusting pricing for these factors helps maintain profitability and also fosters strong customer relationships, forming critical manufacturer price reduction strategies. For instance, a quick adjustment for new import duties can prevent losses and also help maintain competitive pricing in certain regions. This requires continuous monitoring of global economic indicators as well as a flexible internal decision-making process.

Customer-Centricity

Understanding the customer is, indeed, central to effective pricing. Manufacturers must, consequently, develop a deep understanding of their target audiences’ needs, including preferences and, crucially, their price sensitivity. This involves comprehensive market research, customer surveys, and analysis of purchasing behavior. By segmenting customers, therefore, manufacturers can tailor pricing and also understand the value each segment places on specific features or services. This customer-centric approach, furthermore, optimizes pricing and enhances customer satisfaction and loyalty, which is essential for successful manufacturer price reduction strategies. Companies like Caterpillar, for example, use extensive customer feedback to refine products, service, and pricing models.

Supplier Collaboration

Strong supplier relationships are, indeed, fundamental, as they help manage input costs. Input costs, consequently, directly impact a manufacturer’s ability to adjust pricing. Working closely with suppliers can lead to better negotiation terms and also reduce raw material costs. Moreover, such collaboration creates greater stability in the supply chain. Collaborative efforts might, for instance, include long-term contracts or joint cost-reduction initiatives. Sharing demand forecasts, furthermore, helps optimize inventory for both parties. This strategic collaboration creates a more resilient and also cost-effective manufacturing ecosystem, thus providing more leeway for flexible supply chain pricing methods and overall manufacturer price reduction strategies.

The Future of Manufacturer Pricing: Towards Intelligent Automation

The trajectory of manufacturer pricing moves toward greater intelligence, automation, and deeper integration. Static pricing sheets and annual reviews are insufficient to navigate complex market dynamics. The future demands systems that learn, adapt, and optimize pricing in real-time, forming the backbone of advanced manufacturer price reduction strategies.

Predictive analytics, powered by advanced AI and machine learning, will become standard. Manufacturers will use these tools for proactive strategy formulation, forecasting price change impact. Pricing systems will integrate with ERP, CRM, and SCM platforms, creating a holistic business view, enabling informed decisions. This interconnectedness allows for nuanced industrial pricing adjustments balancing profitability, market share, inventory, and customer satisfaction.

Emphasis will shift to a cross-functional approach to pricing. Sales, marketing, finance, and product development teams will collaborate closely, ensuring pricing strategies align with overall business objectives and customer value propositions. Manufacturers embracing intelligent, integrated, and agile factory pricing tactics will be best positioned for sustainable competitive advantage and long-term profitability.

Conclusion

Manufacturer price reduction strategies are, undeniably, sophisticated tools, essential for navigating modern market complexities. Dynamic pricing, for instance, responds to real-time fluctuations, while value-based approaches align with customer perception. Each strategy, furthermore, offers unique advantages. Manufacturers utilize these factory pricing tactics for critical reasons: they penetrate new markets, manage inventory, and also respond to competitive threats and adapt to economic shifts. Moreover, they can pass on cost efficiencies.

However, implementing any price reduction must be a calculated, strategic decision. Its impact on profitability, market share, brand perception, and competitive dynamics requires careful thought when shaping manufacturer price reduction strategies. Success, furthermore, relies on robust cost control, advanced data analytics, and proactive market agility. A deep understanding of customer value and strong supplier collaboration are also key. As the manufacturing landscape evolves, agility, data, and customer focus in pricing will define market leaders, ensuring long-term profitability and sustained competitive advantage through effective enterprise pricing models.