The AMD NVIDIA pricing response critically shapes the high-stakes computing market today. Advanced Micro Devices (AMD), a formidable challenger, consequently employs a dual-front strategy. This approach targets NVIDIA’s dominance and aggressive pricing across two pivotal markets. These include consumer gaming GPUs and the rapidly expanding AI accelerator space. However, it’s not simply about matching prices. Instead, this multi-faceted campaign involves strategic pricing, innovative tech development, and high-stakes partnerships. Ultimately, AMD aims to reshape the competitive landscape and secure its future as a tech leader.

The Gaming GPU Arena: AMD NVIDIA Pricing Response in a Strategic Price-Performance Play

AMD often offers strong price-to-performance in graphics cards. This approach, therefore, appeals to budget-conscious gamers who seek value without losing gaming quality. Specifically, AMD delivers robust rasterization performance. Its cards, furthermore, often boast generous VRAM, which is key for modern games at high settings. Consequently, raw power per dollar largely defines the Radeon brand, showcasing a clear AMD pricing strategy focused on value.

The RDNA 4 Offensive: AMD Pricing Strategy Against NVIDIA’s RTX 50 Series

AMD’s Radeon RX 9000 series is highly anticipated, especially since it utilizes the new RDNA 4 architecture. AMD, moreover, plans aggressive pricing for these cards. This aggressive pricing strategy directly challenges NVIDIA’s RTX 50 series, representing a crucial AMD NVIDIA pricing response to reclaim market share. Indeed, the RX 7000 series sold slowly before, which prompted AMD to change its market strategy.

Leaked data, for instance, clearly shows AMD’s plans. The RX 9070 XT is a key model, which may launch at $599. This price point directly targets NVIDIA’s RTX 5070 Ti; in contrast, that card is projected to cost around $749. Similarly, the RX 9070 base model should be $499, thereby undercutting NVIDIA’s RTX 5070, which is expected at $549. Ultimately, this Radeon pricing commitment to superior value aims to attract buyers by offering more performance per dollar in the ongoing NVIDIA AMD competition.

Real-World Retail Realities and the AMD NVIDIA Pricing Response to MSRP Challenges

AMD’s MSRPs often look good; however, getting products to buyers adds problems. Consequently, AMD struggles to keep retail prices at MSRP, complicating its intended AMD pricing strategy. High demand, for example, can significantly raise street prices, as happened with past Radeon launches. Initial scarcity, therefore, often inflated costs.

Market prices, eventually, usually stabilize later, with prices returning to MSRP as supply grows. Consumers, however, must note this retail variation, which impacts the broader GPU market battle. They weigh hype and advertised prices; in addition, they also check availability and real store prices. This gap, as a result, can weaken AMD NVIDIA pricing response strategies.

Technological Innovation and FSR Development: Bridging the Feature Gap in the GPU Market Battle

AMD invests in new technology, consequently boosting Radeon GPU appeal. The RDNA 4 architecture, furthermore, will bring improvements. A key focus area is AI upscaling; however, NVIDIA has traditionally led in this area. This development, therefore, directly tackles NVIDIA’s main strength: DLSS, showcasing a critical aspect of the ongoing NVIDIA AMD competition. Specifically, DLSS uses AI to render games at low resolution and then intelligently upscales them, boosting frames while maintaining high visual quality.

Meanwhile, AMD offers FidelityFX Super Resolution (FSR), an open-source upscaling tool. FSR’s open design is a deliberate choice; furthermore, it works on many GPUs, including older NVIDIA cards. Consequently, more developers may use it, and more users can benefit. Although FSR 3 had little market impact, FSR 4 shows promise. It utilizes AI advancements, indeed, aiming to improve image quality and performance. This could close the gap with DLSS, therefore potentially making FSR a key selling point. Ultimately, it would strengthen AMD’s gaming position by offering a strong, open alternative to NVIDIA’s tech, intensifying the NVIDIA AMD competition.

NVIDIA’s Iron Grip: Dominance and its Impact on AMD NVIDIA Pricing Response

NVIDIA dominates the discrete GPU market. It built this strong position over decades; consequently, market reports show its firm grip. AMD, therefore, faces a huge challenge in the GPU market battle, as it struggles to gain gaming market share.

Unrivaled Market Share and the AI GPU Hegemony: NVIDIA’s AMD Pricing Strategy Advantage

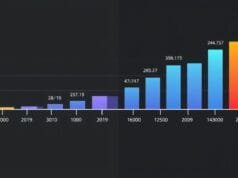

For instance, NVIDIA held 92% of the discrete GPU market in Q1 2025, whereas AMD’s share was just 8%. This trend, furthermore, worsened in Q2 2025, with NVIDIA rising to 94% and AMD dropping to 6%. These numbers, therefore, clearly show AMD’s struggle in the NVIDIA AMD competition. New RDNA 4 cards, consequently, face an uphill fight, as NVIDIA benefits from strong brand loyalty, perceived tech superiority, and a robust ecosystem, impacting potential Radeon pricing strategies.

Moreover, NVIDIA also dominates the AI accelerator space, holding 80% to 95% market share. This near-monopoly, however, is not just about hardware; crucially, while its H100 and B100 GPUs are powerful, its proprietary CUDA software is key. CUDA offers a strong ecosystem; furthermore, developers widely use its tools, libraries, and frameworks, making it an AI development standard. Porting CUDA models takes huge effort, consequently creating vendor lock-in and a significant barrier for competitors like AMD’s ROCm, affecting the broader AMD AI chip strategy.

NVIDIA’s Aggressive Pricing Tactics and Justification in the NVIDIA AMD Competition

NVIDIA holds strong market positions; consequently, it possesses great pricing power, influencing the overall AMD NVIDIA pricing response dynamic. The company, in fact, raised prices by 5-15% across both gaming and AI GPUs. These increases, furthermore, cover rising costs, tariffs, and R&D. NVIDIA justifies its premium prices specifically by citing superior ray tracing, which creates lifelike visuals. Moreover, its advanced and effective DLSS upscaling technology, alongside a mature software ecosystem spanning gaming, professional tools, and AI, also supports its pricing.

Even market leaders, however, face changes. For instance, oversupply could happen, potentially leading to slower RTX 50 series GPU sales. NVIDIA, therefore, might then cut prices to move inventory, showcasing a potential AMD NVIDIA pricing response from the market leader. This demonstrates a flexible strategy where NVIDIA balances high margins with sales, thus adapting when conditions require.

AMD’s Strategic Pivot: The AI Accelerator Gambit and AMD AI Chip Strategy

AMD challenges NVIDIA’s gaming GPUs, which remains a key goal. However, AMD also recognizes huge growth potential in AI accelerators. This market, consequently, is strategically vital, offering significant revenue chances and tech leadership within the broader GPU market battle. Indeed, as AI will shape computing’s future, AMD’s strategy is clear: gaining AI market share is more than just competing; rather, it’s about AMD’s future as a high-growth tech firm. Analysts, therefore, increasingly see AMD as a strong long-term bet, even if it is currently a “distant second” in AI chips.

The Instinct MI Series: AMD’s Hardware for AI and its AMD AI Chip Strategy

AMD offers its Instinct MI series, which are its dedicated AI accelerators. These chips, specifically MI300 and MI450, are purpose-built to compete with NVIDIA’s H100 and B100. They deliver high-performance computing, furthermore, optimizing for AI workloads such as large language model training and inference tasks, which drive AI innovation. In addition, AMD continuously improves its ROCm software stack, an open-source CUDA alternative. ROCm aims for a robust software environment; however, it still trails CUDA in maturity, as NVIDIA’s platform boasts more developer interest and a broader ecosystem.

How is AMD challenging NVIDIA’s dominance in the gaming GPU market with its AMD pricing strategy?

AMD recently made a key AI move: it partnered with OpenAI, a cornerstone of its ambitious AMD AI chip strategy. This, in fact, is a multi-billion-dollar deal. OpenAI leads AI research and deployment, and consequently, AMD’s Instinct MI450 chips will power OpenAI’s AI infrastructure. This agreement is groundbreaking; indeed, analysts call it a “major validation moment” for AMD. It demonstrates that AMD’s AI hardware is mature, and furthermore, its performance meets tough AI demands, capable of handling massive-scale AI development.

This partnership, moreover, has wide tech implications. It could increase AI chip competition and, consequently, offers an alternative to NVIDIA’s monopoly. A second source for AI accelerators, in addition, helps to ease supply bottlenecks, allowing faster AI development. Increased competition, therefore, could pressure NVIDIA, potentially speeding up innovation and prompting NVIDIA to re-evaluate AI pricing in response to this strengthened NVIDIA AMD competition. Ultimately, AMD is now a key AI enabler, demonstrating top-tier AI delivery capacity.

Analyst Outlook and Execution Risks in the GPU Market Battle

Analysts generally like AMD’s long-term outlook, specifically noting its aggressive AI investments, which are a critical component of its AMD AI chip strategy, and the key OpenAI partnership. They, therefore, foresee significant revenue growth ahead as large AI deals come to fruition and AMD gains AI market share. The huge growth in AI hardware demand, consequently, makes AMD attractive to investors.

However, these big projects come with inherent challenges. Analysts, for instance, warn of “execution risk,” which affects huge undertakings. Can AMD meet production schedules and deploy on time? Specifically, it must deliver many AI GPUs for hyperscalers and AI developers. Challenges, in addition, include complex supply chains, ensuring manufacturing quality at scale, and providing fast software updates to satisfy evolving AI workloads. Ultimately, scaling manufacturing and establishing robust supply chains are critical for AMD to deliver on performance and secure its AMD AI chip strategy ambitions.

Navigating the Competitive Landscape: AMD NVIDIA Pricing Response Perspectives and Challenges

AMD and NVIDIA compete in a complex market, a true GPU market battle. Diverse segments shape it; furthermore, tech nuances and changing demands also play a role. Both firms, consequently, face unique pressures, yet also have distinct opportunities as they seek market share and tech leadership.

The Consumer’s Dilemma: Balancing Priorities Amidst AMD NVIDIA Pricing Response

Gamers, therefore, face a complex choice between AMD Radeon and NVIDIA GeForce in this intense NVIDIA AMD competition. AMD cards often have better rasterization, meaning they render game graphics faster. They, furthermore, typically offer more VRAM, which helps modern games at high settings. However, NVIDIA leads in ray tracing, a technology that creates lifelike lighting and reflections, albeit with a performance impact. NVIDIA’s DLSS upscaling, moreover, is strong, and many users prefer its image quality. NVIDIA’s ecosystem is broader, in addition, with CUDA for computing and NVENC offering superior video encoding, leading professionals to often choose GeForce.

Retail prices also vary greatly; consequently, they can exceed AMD’s MSRP, complicating the effectiveness of Radeon pricing strategies and making finding “best value” harder.

AMD’s Profit Focus Versus Market Share Pursuit in the NVIDIA AMD Competition

Critics say AMD seeks profits over market share. This approach, consequently, allowed NVIDIA to set higher GPU prices, influencing the overall AMD NVIDIA pricing response. AMD, in fact, sometimes priced cards too near NVIDIA’s, even with VRAM or rasterization advantages, a questionable AMD pricing strategy for market gain. However, consumers often chose NVIDIA instead, valuing features like ray tracing, brand loyalty, and software. This link, for instance, is seen in Q1 2024 when Radeon GPU sales “nosedived.” AMD’s cards were priced near NVIDIA’s then, therefore, the price-to-performance gap was too small to overcome NVIDIA’s established position. Balancing profit and market share is tough for AMD, and this impacts its long-term gaming future.

NVIDIA’s Defensive Maneuvers: Doubling Down on AI

NVIDIA sees AMD’s AI progress; however, it is not staying idle. The company, consequently, works diligently to defend its dominance. NVIDIA, furthermore, also strengthened ties with OpenAI, which is a clear defense strategy. Reports suggest NVIDIA may invest $100 billion, specifically, to supply OpenAI’s AI infrastructure. This shows NVIDIA’s ambition to maintain AI market leadership; therefore, it commits vast resources to counter rivals like AMD in the intensifying NVIDIA AMD competition. Ultimately, the AI market is a high-stakes fight, and both giants will deploy capital and innovation to secure their future.

Conclusion

AMD counters NVIDIA’s pricing and dominance; indeed, its AMD NVIDIA pricing response is a strategic and nuanced dual-front approach. In gaming GPUs, for instance, AMD focuses on value, with its RDNA 4 lineup offering great price-to-performance. FSR technology, furthermore, also sees big advancements. This strategy, consequently, provides compelling alternatives and aims to reclaim lost market share.

In addition, AMD also makes significant AI strides. The AI accelerator sector is high-growth, and AMD leverages its Instinct MI chips while forming transformative partnerships. The OpenAI deal, specifically, is a key one. This AI pivot is a long-term play, therefore enabling AI’s future while challenging NVIDIA’s strong position in the NVIDIA AMD competition, a core part of AMD’s AMD AI chip strategy.

However, AMD faces a huge challenge: it must unseat NVIDIA’s dominance. Its strategies, consequently, aim to gain market share and position AMD as a vital computing force in this ongoing GPU market battle. The rivalry, indeed, promises innovation and drives intense competition. This dynamic landscape benefits consumers and the broader tech ecosystem. Ultimately, coming years will show AMD’s full impact as it navigates this complex market.

Frequently Asked Questions

How is AMD challenging NVIDIA’s dominance in the gaming GPU market?

AMD challenges NVIDIA in gaming GPUs, primarily by using aggressive Radeon pricing for its RX 9000 series. This RDNA 4 architecture, furthermore, aims for better price-to-performance, directly competing with NVIDIA’s RTX 50 series in the NVIDIA AMD competition. AMD, in addition, invests in FSR 4 with AI; consequently, this upscaling tech competes with DLSS and boosts gaming across many hardware types.

What is AMD’s strategy in the AI accelerator market?

AMD invests heavily in AI accelerators; specifically, its Instinct MI series chips are key to its AMD AI chip strategy. They are purpose-built for AI workloads, and therefore offer high-performance computing. A major strategy, furthermore, is forming big partnerships. The OpenAI deal, for instance, is a multi-billion-dollar agreement, where AMD’s MI450 chips will power OpenAI’s AI, thereby validating AMD’s AI hardware ability.

Why does NVIDIA hold such a dominant market share in GPUs, especially in AI?

NVIDIA dominates for several reasons, influencing the entire GPU market battle and AMD NVIDIA pricing response. In gaming, for example, it excels in ray tracing, and its advanced DLSS tech is also strong. In AI, furthermore, NVIDIA holds a near-monopoly due to powerful hardware, such as H100 and B100. Its CUDA software ecosystem, moreover, is key, as CUDA causes strong developer lock-in, making it hard for rivals. Brand loyalty and availability, in addition, also help sustain NVIDIA’s lead.

What are the main challenges AMD faces in competing with NVIDIA?

AMD faces big challenges in the NVIDIA AMD competition. First, NVIDIA holds huge market share in both gaming and AI. Second, NVIDIA’s CUDA platform creates strong developer lock-in. Furthermore, AMD struggles to consistently meet MSRP for gaming GPUs, impacting its effective Radeon pricing strategy, as high demand often raises prices. In AI, moreover, AMD has execution risks; it must ramp up production for large orders. Finally, maturing its ROCm software to effectively compete with CUDA is also a significant challenge.

How does AMD’s FSR technology compare to NVIDIA’s DLSS?

NVIDIA’s DLSS is proprietary; it specifically uses AI for upscaling. DLSS offers great image quality and, furthermore, boosts performance. AMD’s FSR, in contrast, is open-source, and it works on more GPUs, including older NVIDIA cards. Early FSR versions, meanwhile, had little market impact. However, FSR 4 with AI is promising; it should improve image quality and performance, thereby narrowing the gap with DLSS. Ultimately, FSR will become a stronger feature for Radeon GPUs, intensifying the NVIDIA AMD competition in the feature department.